USAA is often cheaper than Geico for eligible members. State Farm also offers competitive rates that can be lower.

Finding affordable car insurance is crucial for many drivers. USAA often provides lower premiums, especially for military members and their families. State Farm is another strong contender, known for its competitive pricing and comprehensive coverage options. Comparing quotes from multiple insurers can help you find the best rate tailored to your needs.

Factors like driving history, location, and vehicle type significantly influence insurance costs. Utilizing discounts and bundling policies can also lead to substantial savings. Shopping around and understanding your coverage needs are key to securing the most cost-effective insurance plan.

Introduction To Affordable Car Insurance

Finding affordable car insurance is a priority for many drivers. Saving money on car insurance means having more funds for other needs. It is important to compare different options. This helps in finding the best and most affordable coverage.

The Importance Of Competitive Insurance Rates

Competitive insurance rates help you save money. High rates can strain your budget. Affordable insurance helps in managing expenses better. It ensures you are not overpaying for coverage.

Comparing rates from different companies is crucial. It allows you to find the best deal. Geico is known for its competitive rates. But other companies might offer cheaper options. Always explore various offers before making a decision.

Criteria For Comparing Insurance Companies

Use specific criteria to compare insurance companies. Here are some key factors:

- Coverage Options: Check what each company covers.

- Customer Service: Read reviews and ratings.

- Discounts: Look for available discounts.

- Claim Process: Check how easy it is to file a claim.

- Financial Stability: Ensure the company is financially sound.

Comparing these factors helps in finding the most affordable car insurance. Also, consider using online comparison tools. These tools can simplify the process and save time.

Credit: www.valuepenguin.com

Top Contenders For Cost-efficiency

Finding affordable car insurance is a priority for many. Geico is known for its cost-effective policies. But, there are other contenders that offer competitive rates. Let’s explore the top options.

National Players Vs. Regional Insurers

National players like State Farm and Progressive offer competitive rates. They have a broad reach and many discounts. But, don’t overlook regional insurers. They often provide lower rates and personalized service. Regional companies such as Erie Insurance and Country Financial are worth considering.

| National Insurers | Regional Insurers |

|---|---|

| State Farm | Erie Insurance |

| Progressive | Country Financial |

Both types have their advantages. National players have vast resources. Regional insurers offer tailored policies and community connections.

Emerging Insurance Companies On The Radar

Newer companies are entering the market with innovative approaches. These emerging insurers often provide lower rates. Root Insurance and Metromile use technology to offer customized pricing.

- Root Insurance: Uses driving habits to determine rates.

- Metromile: Charges based on miles driven.

These companies appeal to tech-savvy drivers. They offer flexible and affordable options. Keep an eye on these emerging players for budget-friendly insurance.

Comparative Analysis Of Insurance Premiums

Choosing the right car insurance can save you money. Geico is popular, but there are cheaper options. This post compares Geico with other insurers.

Case Studies: Geico Vs. Competitors

Below are case studies comparing Geico with other insurance companies.

| Insurance Company | Average Annual Premium | Coverage Options |

|---|---|---|

| Geico | $1,200 | Basic, Comprehensive |

| State Farm | $1,100 | Basic, Comprehensive |

| Progressive | $1,150 | Basic, Comprehensive |

| USAA | $1,050 | Basic, Comprehensive |

USAA offers the cheapest average premium at $1,050 per year. State Farm and Progressive also provide competitive rates.

Factors Influencing Insurance Premiums

Several factors affect car insurance premiums. Below are the main factors:

- Driver’s Age: Younger drivers pay higher premiums.

- Driving History: Accidents or tickets increase costs.

- Car Type: Expensive cars have higher premiums.

- Location: Urban areas usually have higher rates.

- Credit Score: Lower scores can mean higher premiums.

Understanding these factors can help you find cheaper insurance. Comparing different companies is essential for saving money.

Customer Satisfaction And Service Quality

Understanding customer satisfaction and service quality is crucial when choosing car insurance. While Geico is popular, other insurers may offer better service.

Customer Reviews And Ratings

Customer reviews and ratings are essential for evaluating car insurance. They provide real experiences from people who use the service.

Many websites collect and display reviews. Look for comments about customer support, claim handling, and overall satisfaction. Check ratings on:

- Customer support

- Claim handling

- Overall satisfaction

Compare these ratings to those of Geico. You might find insurers with higher ratings in some areas.

Claims Processing And Support

Claims processing is a critical part of car insurance. Efficient claims support can save you time and stress.

Examine how quickly and fairly an insurer handles claims. Consider these factors:

- Speed of claim approval

- Ease of filing a claim

- Availability of support

Some insurers may process claims faster than Geico. They might also offer better support during the process.

| Insurer | Claim Approval Time | Support Availability |

|---|---|---|

| Insurer A | 24 hours | 24/7 |

| Insurer B | 48 hours | Weekdays |

| Geico | 36 hours | 24/7 |

Choosing an insurer with better claim support can enhance your experience. Always read customer feedback before making a decision.

Discounts And Deals

Finding cheaper car insurance than Geico can be challenging. However, many companies offer discounts and deals that can help you save money. This section explores some of the best options available.

Loyalty Discounts And Bundling Options

Many insurers reward long-term customers with loyalty discounts. Staying with the same provider can earn you significant savings. Additionally, bundling your insurance policies—such as car and home insurance—can lead to even more discounts.

| Insurance Company | Loyalty Discount | Bundling Options |

|---|---|---|

| State Farm | Up to 20% | Home, Renters, Life |

| Progressive | Varies | Home, Motorcycle, Boat |

| Allstate | Up to 10% | Home, Renters, Life |

Special Offers For Safe Drivers And Students

Safe drivers often receive special discounts for maintaining a clean record. Insurance companies reward good driving habits, lowering your premiums.

- USAA: Up to 30% for safe driving.

- Nationwide: Vanishing deductible for every year of safe driving.

- Liberty Mutual: Accident forgiveness.

Students can also benefit from various discounts. Many insurers offer lower rates for good grades and other achievements.

- Farmers: Good student discount, up to 15%.

- Geico: Good student discount, up to 25%.

- State Farm: Good student and safe driving discount.

Credit: www.marketwatch.com

Technology And User Experience

Finding affordable car insurance can be challenging. Technology and user experience play a crucial role in modern insurance. Many companies now use advanced technology to deliver better services. These innovations help customers save time and money.

Mobile Apps And Online Services

Many insurance companies offer mobile apps and online services. These tools make managing your policy easier. Through a mobile app, you can access your insurance information anytime. This convenience can be a big advantage.

Here are some features you might find in these apps:

- Instant quotes

- Policy management

- Claims filing

- Customer support

Online services are also very helpful. You can often get a quote, update your policy, and file claims online. This saves you from having to visit an office or make a phone call.

Innovations In Insurance Tech

New technologies are changing the car insurance industry. Telematics is one such innovation. It uses devices to track your driving habits. This data can help lower your insurance rates.

| Technology | Benefit |

|---|---|

| Telematics | Lower rates for safe driving |

| AI and Machine Learning | Faster claims processing |

| Blockchain | Enhanced data security |

AI and machine learning also play a significant role. They help in quickly processing claims and detecting fraud. Blockchain technology ensures your data is secure and tamper-proof.

These innovations help many companies offer rates cheaper than Geico. They provide a better user experience and more efficient services.

Coverage Options And Flexibility

Finding cheaper car insurance than Geico is possible. You need to compare coverage options and flexibility. Insurance companies offer various plans and add-ons. This helps you get the best deal.

Customizable Policies

Many insurance companies offer customizable policies. You can choose the coverage you need. This ensures you only pay for what you use.

- Basic Liability

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

Geico has set plans, but other companies allow more customization. This can lead to cheaper rates.

Add-ons And Riders Comparison

Insurance companies offer various add-ons and riders. These extras can enhance your policy. Some common add-ons include:

- Roadside Assistance

- Rental Car Coverage

- Gap Insurance

- Accident Forgiveness

Below is a table comparing Geico’s add-ons with other insurers:

| Add-on | Geico | Other Insurers |

|---|---|---|

| Roadside Assistance | Available | Available |

| Rental Car Coverage | Available | Available |

| Gap Insurance | Not Available | Available |

| Accident Forgiveness | Available | Available |

Comparing these options helps you find cheaper insurance than Geico. Look for insurers offering the add-ons you need at lower costs.

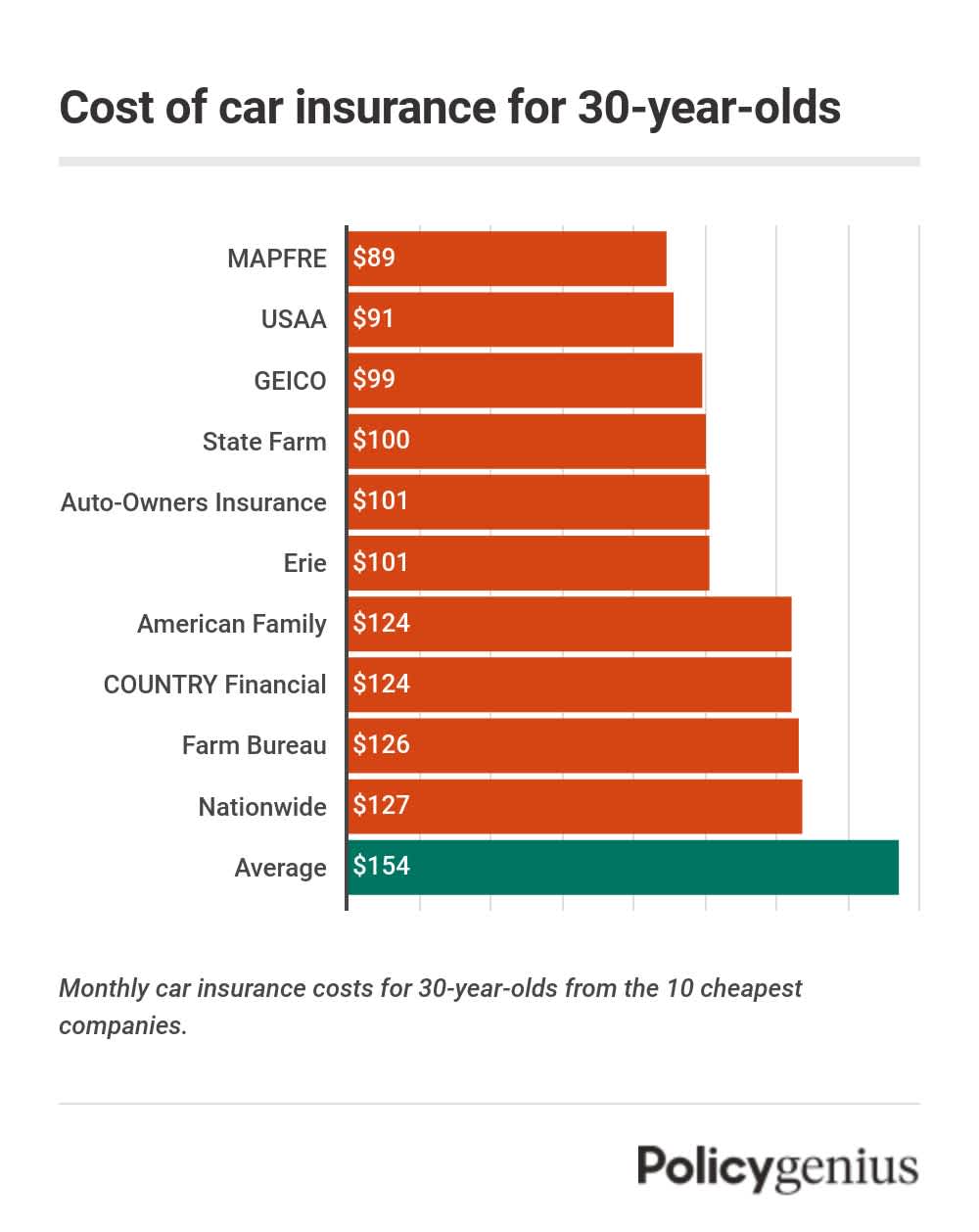

Credit: www.policygenius.com

Making The Switch

Switching car insurance can save you money. Many people wonder if there’s a cheaper option than Geico. The answer is yes. Several insurers offer competitive rates. Let’s explore how to make the switch.

Transitioning To A New Insurer

Start by comparing rates. Use online tools or call different insurers. Check for discounts. Some companies offer lower rates for safe drivers.

Here is a simple table to compare some alternatives:

| Insurance Company | Average Annual Premium |

|---|---|

| Progressive | $1,050 |

| State Farm | $1,100 |

| Allstate | $1,120 |

Once you find a better rate, gather your documents. You will need your current policy, driver’s license, and vehicle details. Contact the new insurer to get a quote. Confirm the coverage meets your needs.

Policy Cancellation And Refunds

Before canceling your Geico policy, check for cancellation fees. Some insurers charge a fee if you cancel early. Call Geico to understand their policy.

To cancel:

- Call Geico customer service.

- Request to cancel your policy.

- Provide your policy number and details.

Ask about any refunds. You may be eligible for a prorated refund. This means you get back money for the unused coverage period.

Ensure your new policy starts before canceling the old one. This prevents any lapse in coverage.

Frequently Asked Questions

Who Is Geico’s Biggest Competitor?

Geico’s biggest competitor is State Farm. They are both leading auto insurance providers in the United States.

Who Is Known For The Cheapest Car Insurance?

Geico is often known for offering the cheapest car insurance. Other affordable options include State Farm and Progressive. Compare quotes to find the best rate.

Is Geico Cheaper Then Progressive?

Geico is often cheaper than Progressive, but rates vary based on individual factors. Always compare quotes for accuracy.

Is Geico The Most Expensive Car Insurance?

Geico is not always the most expensive car insurance. Prices vary based on factors like location, driver history, and coverage needs.

Conclusion

Finding car insurance cheaper than Geico is possible with thorough research. Explore various providers and compare quotes. Consider discounts and coverage options to make an informed choice. By doing so, you can secure affordable insurance that meets your needs. Remember, the right policy can save you money without compromising on protection.