Comprehensive car insurance provides the highest level of coverage for your vehicle, protecting it against non-collision events such as theft, vandalism, and natural disasters. This type of insurance is ideal for those seeking complete protection for their cars.

Comprehensive car insurance offers extensive coverage, safeguarding your vehicle from a wide range of potential risks. It not only covers damage from accidents but also provides protection against theft, vandalism, and natural disasters. As a vehicle owner, opting for comprehensive car insurance can provide you with peace of mind, knowing that your car is well-protected in various scenarios.

With comprehensive car insurance, you can drive confidently, knowing that your vehicle is covered from a wide range of potential risks.

Credit: www.dehayes.com

Introduction To Comprehensive Car Insurance

Comprehensive car insurance is a type of coverage that protects against damage to your vehicle caused by non-collision events. This includes theft, vandalism, weather, and other acts of nature. It is the highest level of cover available in the UK and may be worth considering, especially for new or high-value vehicles.

When it comes to car insurance, it’s important to understand the different types of coverage available to protect your vehicle. One such coverage option is comprehensive car insurance, which provides a higher level of protection beyond just collisions. In this blog post, we will delve into what comprehensive coverage entails and highlight the importance of being insured beyond collisions.

What Comprehensive Coverage Entails

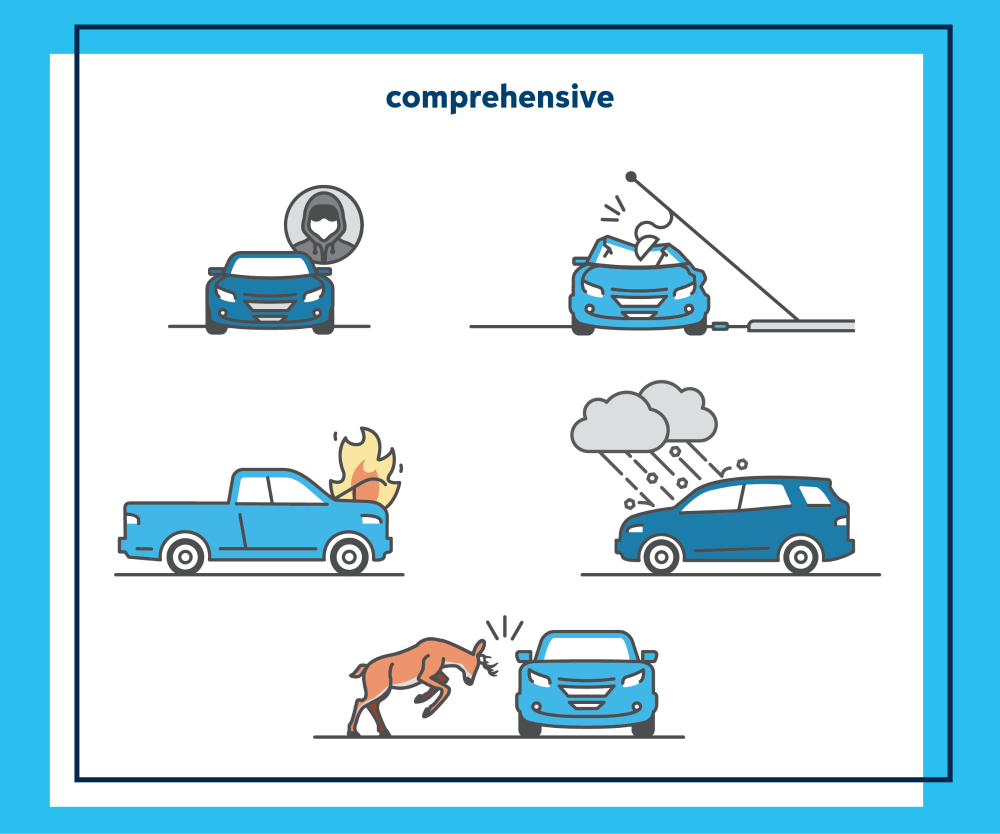

Comprehensive car insurance is an optional coverage that offers financial protection against non-collision events that are beyond your control. This includes incidents such as theft, vandalism, glass and windshield damage, fire, accidents involving animals, weather-related damage, and other acts of nature. Essentially, comprehensive coverage safeguards your vehicle against a wide range of risks, giving you peace of mind in unpredictable situations.

Unlike collision coverage, which only covers damages resulting from collisions with other vehicles or road hazards, comprehensive coverage encompasses a broader scope of incidents. Whether your car gets damaged due to a fallen tree branch, stolen parts, or a cracked windshield, comprehensive insurance has got you covered.

The Importance Of Being Insured Beyond Collisions

Having comprehensive car insurance offers several benefits that go beyond just protecting your vehicle in case of accidents. Here are some key reasons why it’s important to consider comprehensive coverage:

- Protection against theft and vandalism: Car theft and vandalism can happen unexpectedly, leaving you with a significant financial loss. Comprehensive insurance ensures that you are compensated for the damages or loss incurred in such unfortunate incidents.

- Coverage for weather-related damages: Natural disasters and severe weather conditions can wreak havoc on your vehicle. Comprehensive coverage safeguards you against damages caused by hailstorms, floods, hurricanes, and other weather-related events.

- Peace of mind in unpredictable situations: Life is full of uncertainties, and accidents can happen at any time. With comprehensive coverage, you can have peace of mind knowing that your car is protected from a wide range of unexpected events, reducing financial stress and worry.

- Added protection for high-value vehicles: If you own a new or expensive car, comprehensive insurance becomes even more crucial. The higher the value of your vehicle, the higher the potential financial loss in case of damages or theft. Comprehensive coverage ensures that you are adequately compensated for any losses incurred.

- Enhanced resale value: Comprehensive insurance not only protects your vehicle from damages but also helps maintain its resale value. Potential buyers are more likely to be interested in a car that has been well-maintained and protected against a range of risks.

By investing in comprehensive car insurance, you are taking a proactive step towards safeguarding your vehicle and your finances. While it may not be mandatory in every situation, the added protection and peace of mind it provides make it a worthwhile consideration.

Now that we have explored what comprehensive coverage entails and the importance of being insured beyond collisions, you can make an informed decision about whether it is the right coverage option for you and your car.

Credit: www.progressive.com

Key Features Of Comprehensive Car Insurance

Comprehensive car insurance provides coverage for a wide range of potential risks, offering peace of mind to drivers. Let’s explore some of the key features of comprehensive car insurance.

Theft Protection

Comprehensive car insurance provides protection against theft of the insured vehicle. In the unfortunate event of a theft, the policyholder can file a claim to receive compensation for the loss, helping to mitigate the financial impact of such an incident.

Natural Disasters And Environmental Damage

This type of insurance also covers damages caused by natural disasters and environmental damage. Whether it’s damage from a hailstorm, flooding, or falling objects, comprehensive car insurance provides coverage for a variety of environmental risks that could affect the vehicle.

Comparing Comprehensive And Collision Insurance

Comprehensive car insurance covers non-collision damage to your vehicle, such as theft, vandalism, and natural disasters. It is different from collision insurance, which only covers damage from collisions with other vehicles or objects. It may be worth considering comprehensive insurance, especially if you have a new or valuable car.

Comparing Comprehensive and Collision InsuranceWhen it comes to car insurance, you have a few options to choose from. Two of the most popular types of coverage are comprehensive and collision insurance. While both coverages can help protect your vehicle, there are some key differences in the coverage they offer.Differences in CoverageCollision insurance is designed to cover damages to your vehicle that result from a collision with another vehicle or object, such as a tree or guardrail. This coverage typically pays for repairs to your car, or for the value of your car if it is totaled in the accident.Comprehensive insurance, on the other hand, covers damages to your vehicle that are caused by non-collision events. This includes things like theft, vandalism, weather-related damage, and accidents with animals. Comprehensive coverage can also help cover the cost of repairing or replacing your vehicle if it is damaged in a natural disaster, such as a flood or earthquake.Which One Should You Choose?Deciding between comprehensive and collision insurance can be a tough choice. If you have a newer car or a car that is worth a lot of money, you may want to consider getting both types of coverage. However, if you have an older car that isn’t worth a lot, you may be able to get by with just liability insurance.Ultimately, the type of coverage you choose will depend on your specific needs and budget. It’s important to talk to your insurance agent to determine which coverage is right for you.In conclusion, when choosing between comprehensive and collision insurance, it’s important to consider the coverage each option offers and to choose the one that best fits your needs. By doing your research and working with your insurance agent, you can ensure that you have the protection you need to keep your vehicle safe on the road.Is Comprehensive Car Insurance Right For You?

Comprehensive car insurance provides the highest level of coverage, protecting your vehicle against non-collision events like theft, vandalism, and natural disasters. It’s worth considering if you have a new car or if your vehicle holds significant value. This type of insurance offers added peace of mind for unforeseen circumstances.

Evaluating Your Vehicle’s Value

Before deciding whether comprehensive car insurance is right for you, it’s important to evaluate the value of your vehicle. Comprehensive coverage is designed to protect against non-collision events that are outside of your control, such as theft, vandalism, fire, and weather-related damage. If your vehicle is older or has a lower value, the cost of comprehensive coverage may outweigh the potential benefits.Weighing Cost Against Benefits

When deciding whether to purchase comprehensive car insurance, it’s important to weigh the cost against the benefits. While comprehensive coverage can provide valuable protection, it can also be more expensive than other types of coverage. Consider factors such as the value of your vehicle, your driving habits, and your budget when making your decision.Ultimately, whether comprehensive car insurance is right for you will depend on your individual needs and circumstances. By evaluating your vehicle’s value and weighing the cost against the benefits, you can make an informed decision about the coverage that is right for you.What Comprehensive Insurance Covers

Comprehensive car insurance provides coverage for damages to your vehicle caused by non-collision events such as theft, vandalism, fire, and weather-related incidents. It also includes protection against accidents with animals and windshield damage. This type of insurance is a good option to consider, especially if you have a new or valuable car.

Vandalism And Theft

Comprehensive car insurance provides coverage for damages to your vehicle caused by vandalism and theft. Whether your car is targeted by vandals who scratch the paint or break the windows, or it is stolen entirely, comprehensive insurance has you covered.

Animal-related Damage

Comprehensive insurance also protects against damages caused by animals. If you collide with an animal on the road, such as a deer or a dog, comprehensive insurance will cover the costs of repairing your vehicle. This coverage extends to damages caused by animals outside of collisions as well, like if a raccoon damages your car while trying to access food.

Acts Of Nature And Weather Events

Comprehensive insurance covers damages to your vehicle caused by acts of nature and weather events. Whether it’s hail damage, a fallen tree branch, or flooding due to heavy rain, comprehensive insurance will help you repair or replace your car. It also provides coverage in the event of a fire or if your vehicle is damaged by a tornado or hurricane.

Comprehensive car insurance offers peace of mind by protecting you against a range of non-collision events that are outside of your control. With coverage for vandalism, theft, animal-related damage, and acts of nature and weather events, comprehensive insurance ensures that you are financially protected from unexpected expenses. It is important to carefully review your policy to understand the specific coverage and any deductibles that may apply.

What’s Not Covered: The Exclusions

Comprehensive car insurance provides coverage for non-collision events that are beyond your control, such as theft, vandalism, fire, and weather damage. It does not cover damages resulting from collisions with other vehicles or objects. Consider adding comprehensive coverage to your policy, especially if you have a new or high-value car.

Limitations Of Comprehensive Insurance

Comprehensive insurance does not cover everything. It typically excludes general wear and tear, mechanical breakdowns, and regular maintenance costs. Additionally, it usually does not cover personal belongings inside the car, aftermarket accessories, or custom parts.Common Misconceptions Clarified

Some misconceptions about comprehensive insurance include the belief that it covers everything related to the car, which is not true. It is important to understand the specific exclusions and limitations of comprehensive coverage to avoid any surprises in the event of a claim.Cost Of Comprehensive Car Insurance

Comprehensive car insurance provides extensive coverage against non-collision events, including theft, vandalism, and natural disasters. It offers financial protection for a wide range of situations, ensuring peace of mind for drivers. The cost of comprehensive car insurance varies based on factors such as the driver’s age, location, and the value of the vehicle.

Factors Influencing Premiums

Various factors affect the cost of comprehensive car insurance. The make and model of your car, your age, driving history, and location all play a role in determining your premium.

Additionally, the level of coverage you choose and any optional add-ons will impact the overall cost of your comprehensive insurance policy.

Saving Money On Your Policy

To save money on your comprehensive car insurance, consider increasing your deductible. A higher deductible typically means lower premiums.

Furthermore, bundling your car insurance with other policies, such as home insurance, can often lead to discounted rates from insurance providers.

Filing A Claim With Comprehensive Insurance

Comprehensive car insurance provides coverage for a wide range of non-collision incidents, including theft, vandalism, and natural disasters. When filing a claim with comprehensive insurance, you can receive compensation for damages to your vehicle that are beyond your control, such as those caused by weather or accidents with animals.

The Claims Process

When filing a claim with comprehensive insurance, the process typically involves contacting your insurance provider to report the incident. You will need to provide details such as the date, time, and location of the event, along with any relevant documentation.

Tips For A Smooth Claim Experience

For a smoother claim experience, follow these tips:

- Document the damage with photos and detailed notes.

- File your claim promptly to expedite the process.

- Cooperate fully with your insurance company’s investigation.

- Keep records of all communication with your insurer.

- Review your policy to understand coverage limits and deductibles.

Myths Vs. Facts: Understanding Comprehensive Insurance

Comprehensive car insurance provides coverage for non-collision events like theft, vandalism, and natural disasters. It’s important to understand the myths and facts surrounding comprehensive insurance to make informed decisions about car insurance coverage. Understanding comprehensive insurance can help protect your vehicle from a wide range of potential risks.

Debunking Common Myths

Myth: Comprehensive insurance only covers collisions.

Fact: Comprehensive insurance covers non-collision events like theft and weather damage.

Facts To Know Before Buying

Myth: Comprehensive insurance is expensive.

Fact: Comprehensive insurance can be affordable and offers extensive coverage.

Credit: www.auto-owners.com

Choosing The Right Insurance Provider

When it comes to selecting comprehensive car insurance, choosing the right insurance provider is crucial. With numerous options available in the market, it can be overwhelming to make a decision. However, by considering a few key factors, you can find the perfect insurance provider that meets your needs and provides you with the necessary coverage.

Comparing Insurance Companies

When choosing the right insurance provider for your comprehensive car insurance, it’s important to compare different companies to find the best fit for you. Here are some factors to consider when comparing insurance companies:

- Policy Coverage: Look for a provider that offers comprehensive coverage that includes protection against non-collision events such as theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature.

- Cost: Compare the premiums offered by different insurance companies to ensure you are getting the best value for your money.

- Discounts and Benefits: Check if the insurance provider offers any discounts or additional benefits such as a no-claims bonus, roadside assistance, or a courtesy car in case of an accident.

- Customer Service: Research the reputation of the insurance company for its customer service, responsiveness, and ease of claims process.

By carefully comparing insurance companies based on these factors, you can make an informed decision and choose the right insurance provider for your comprehensive car insurance needs.

Reading Customer Reviews And Ratings

Another important aspect of choosing the right insurance provider is reading customer reviews and ratings. This can provide valuable insights into the experiences of other policyholders and help you gauge the reliability and trustworthiness of the insurance company. Here’s why reading customer reviews and ratings is essential:

- Feedback: Customer reviews can give you an idea of the overall satisfaction level of policyholders with the insurance company’s services.

- Claims Process: Reviews can shed light on the efficiency and effectiveness of the insurance company’s claims process, helping you understand how hassle-free it is to file a claim.

- Customer Support: Reading reviews can give you an understanding of the insurance company’s customer support quality and how they handle queries or concerns.

By taking the time to read customer reviews and ratings, you can gain valuable insights and make a more informed decision when choosing the right insurance provider for your comprehensive car insurance.

Frequently Asked Questions

What Does Comprehensive Mean In Car Insurance?

Comprehensive car insurance covers non-collision damage to your vehicle, such as theft, vandalism, and natural disasters.

Is It Better To Have Collision Or Comprehensive?

Comprehensive coverage is better than collision coverage because it protects against a wider range of damages to your vehicle. Collision coverage only pays for damages from collisions with other vehicles or road hazards, while comprehensive coverage also covers theft, vandalism, weather damage, and other non-collision events.

It’s worth considering comprehensive coverage, especially if you have a new or valuable car.

Is It Worth Getting Comprehensive?

Comprehensive car insurance is worth getting, especially if you have a new car or a high-value vehicle. It provides coverage for non-collision events such as theft, vandalism, fire, and weather damage. Adding comprehensive insurance to your policy can give you peace of mind and protect your investment.

What Is The Difference Between Basic And Comprehensive Car Insurance?

Basic car insurance covers liability for injuries and property damage, while comprehensive covers damage from unexpected events like natural disasters and falling objects.

Conclusion

Comprehensive car insurance offers extensive protection against non-collision events such as theft, vandalism, and natural disasters. It provides peace of mind and financial security for car owners, especially those with new or high-value vehicles. By understanding the coverage and benefits, individuals can make informed decisions to safeguard their vehicles.