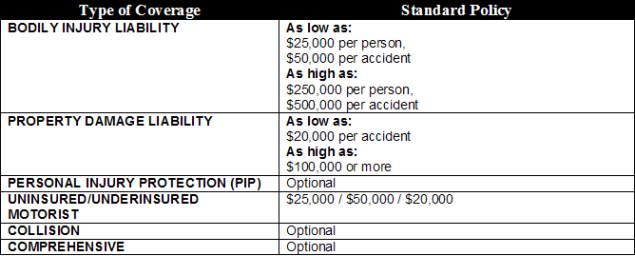

In Virginia, drivers must carry minimum liability insurance of $25,000 per person and $50,000 per accident. Additionally, they need $20,000 for property damage.

Virginia law mandates that all drivers have sufficient car insurance to cover potential damages and injuries in an accident. This minimum coverage ensures that drivers can handle financial responsibilities if they cause harm to others or their property. While these are the required limits, many experts recommend purchasing higher coverage to better protect assets and avoid out-of-pocket expenses.

Understanding these requirements helps Virginia drivers stay compliant and secure on the road. For peace of mind, reviewing and possibly increasing coverage levels is advisable.

Credit: www.marksandharrison.com

Introduction To Virginia Car Insurance Requirements

Car insurance is a must for every driver in Virginia. It ensures safety and financial protection. Understanding the specific requirements helps you stay compliant and protected.

The Importance Of Car Insurance

Car insurance protects you from huge financial losses. It covers damages to your vehicle and others’ property. It also provides medical coverage if you get injured in an accident.

Without insurance, repair costs can be overwhelming. Legal issues can also arise if you’re uninsured. Having car insurance offers peace of mind.

Virginia’s Legal Stance On Auto Coverage

Virginia has clear laws about car insurance. You must have liability coverage. This covers injuries and property damage you cause in an accident.

Virginia requires minimum coverage of:

- $25,000 for bodily injury per person

- $50,000 for total bodily injury per accident

- $20,000 for property damage

You can choose to pay an Uninsured Motor Vehicle (UMV) fee. This fee allows you to drive without insurance, but it’s risky. You are still responsible for any damages.

Minimum Coverage Standards In Virginia

In Virginia, car insurance is mandatory to ensure protection for all. The state has set minimum coverage standards to help cover costs in an accident. Let’s understand the required minimums for car insurance in Virginia.

Bodily Injury Liability

Bodily injury liability is essential. It helps cover costs if you hurt someone in a crash. In Virginia, the minimum coverage is:

- $30,000 for injuries to one person

- $60,000 for injuries to two or more people

Property Damage Liability

Property damage liability covers damage to another person’s property. This could be their car, fence, or even a building. In Virginia, the minimum coverage is:

- $20,000 for property damage per accident

Uninsured Motorist Coverage

Uninsured motorist coverage helps if the other driver has no insurance. It also covers if the other driver is underinsured. In Virginia, the minimum coverage is:

- $30,000 for injuries to one person

- $60,000 for injuries to two or more people

- $20,000 for property damage per accident

Understanding Uninsured Motorist Protection

Uninsured Motorist (UM) Protection is crucial in Virginia. It safeguards you if hit by an uninsured driver. This coverage ensures you are not left with hefty bills. Let’s explore the specifics.

Coverage For Uninsured Drivers

Uninsured Motorist Coverage protects you if the at-fault driver has no insurance. It covers medical expenses, lost wages, and other damages. This coverage also applies if you are a pedestrian hit by an uninsured driver. Here’s a quick overview:

| Benefit | Description |

|---|---|

| Medical Expenses | Covers your hospital and treatment costs. |

| Lost Wages | Compensates for income lost due to injury. |

| Other Damages | Includes pain and suffering, and other non-economic damages. |

Underinsured Motorist Coverage

Underinsured Motorist (UIM) Coverage steps in if the at-fault driver’s insurance is insufficient. It bridges the gap between their coverage and your actual expenses. Here’s how it works:

- Evaluates the at-fault driver’s insurance limits

- Covers the remaining costs up to your policy limits

- Ensures you are fully compensated

Underinsured Motorist Coverage is essential. It offers peace of mind knowing you are protected against insufficient coverage.

Virginia requires both Uninsured and Underinsured Motorist Coverage. This ensures you are protected against both uninsured and underinsured drivers.

Optional Car Insurance Add-ons

Virginia requires basic car insurance, but additional options can enhance protection. These optional add-ons provide extra coverage for various situations. Let’s explore some key optional car insurance add-ons available in Virginia.

Collision Coverage

Collision Coverage helps pay for repairs to your vehicle after an accident. It covers damage from collisions with other cars or objects. This coverage is especially useful if your car is new or valuable. With collision coverage, you can avoid high repair costs.

Comprehensive Coverage

Comprehensive Coverage protects your car from non-collision incidents. It covers events like theft, vandalism, and natural disasters. Comprehensive coverage also includes damage from falling objects or hitting an animal. This coverage offers peace of mind for unpredictable events.

Medical Payments Coverage

Medical Payments Coverage helps pay for medical expenses after an accident. It covers you, your passengers, and even pedestrians. This coverage is useful regardless of who is at fault. Medical payments coverage can help with hospital bills, surgeries, and other medical costs.

| Coverage Type | Description | Benefits |

|---|---|---|

| Collision Coverage | Repairs for accident-related damages | Avoid high repair costs |

| Comprehensive Coverage | Protection from non-collision incidents | Peace of mind for unpredictable events |

| Medical Payments Coverage | Medical expense coverage | Help with hospital and medical bills |

The Virginia Insurance Verification Program

The Virginia Insurance Verification Program ensures drivers have valid car insurance. The program checks if all vehicles meet the state’s insurance requirements. This system helps keep uninsured drivers off the roads.

Electronic Reporting By Insurers

Insurers must report insurance details electronically to the state. This electronic reporting makes verification fast and accurate. It reduces the chance of errors or outdated information.

| Requirement | Details |

|---|---|

| Reporting Method | Electronic |

| Frequency | Regular Intervals |

| Information Required | Policy Number, Vehicle Details |

Penalties For Insurance Violations

Drivers face penalties for insurance violations in Virginia. Penalties include fines, license suspension, and vehicle impoundment. The penalties ensure compliance and road safety.

- Fines: Monetary penalties for driving without insurance.

- License Suspension: Loss of driving privileges.

- Vehicle Impoundment: Seizure of the uninsured vehicle.

These penalties serve as a deterrent. They encourage drivers to maintain proper insurance coverage.

Credit: www.marketwatch.com

How To Prove Financial Responsibility

In Virginia, car owners must show proof of financial responsibility. This means they need to prove they can cover costs from accidents. There are two main ways to do this: an Insurance ID Card or a Certificate of Self-Insurance.

Insurance Id Card

One common way to show financial responsibility is with an Insurance ID Card. This card proves you have the required insurance. It must be kept in your car at all times.

The Insurance ID Card should include:

- Policy number

- Policyholder’s name

- Effective dates of coverage

- Insurer’s name

If you get pulled over, show this card to the police. If you are in an accident, exchange this card with the other driver. Not having this card can lead to fines and penalties.

Certificate Of Self-insurance

Another way to prove financial responsibility is with a Certificate of Self-Insurance. This option is for owners of large fleets of vehicles. To get this certificate, you must apply through the Virginia Department of Motor Vehicles (DMV).

Requirements for a Certificate of Self-Insurance include:

- Owning a large number of vehicles

- Showing financial stability

- Meeting specific DMV criteria

Once approved, the DMV will issue a Certificate of Self-Insurance. Keep this certificate in your vehicles. It serves as proof you can cover accident costs without traditional insurance.

Factors Influencing Insurance Premiums In Virginia

Understanding what affects car insurance premiums can help save money. In Virginia, several factors determine how much you pay for car insurance. These factors include your driving record, vehicle type, and credit score.

Driving Record And History

A clean driving record often results in lower premiums. Traffic violations and accidents increase your risk profile. Insurance companies consider these when setting rates. Safe drivers usually enjoy better rates.

Vehicle Type And Usage

The type of vehicle you drive also impacts your premiums. Luxury cars and sports cars tend to have higher insurance costs. This is due to the high cost of repairs and replacement. How you use your vehicle matters too. Daily commuters may pay more than occasional drivers.

Credit Score Impact

Your credit score plays a role in determining your insurance premium. A higher credit score often means lower premiums. Insurers use credit scores to predict risk. Paying bills on time can help improve your score.

Steps To Acquire Car Insurance In Virginia

Getting car insurance in Virginia is essential. It ensures you meet legal requirements and protects you financially. Follow these steps to secure the right coverage.

Shopping For Insurance Quotes

Start by gathering insurance quotes from different providers. Use online tools to compare rates. It’s easy and fast.

- Visit insurance company websites.

- Enter your vehicle and driver details.

- Get quotes and compare prices.

Check for discounts and special offers. Many insurers provide deals for safe drivers or multiple policies.

Understanding Policy Terms

Read the policy terms carefully. Understand what each term means. Make sure you know the coverage limits and deductibles.

| Term | Definition |

|---|---|

| Liability Coverage | Pays for damage you cause to others. |

| Collision Coverage | Pays for damage to your car in an accident. |

| Comprehensive Coverage | Covers non-collision damage, like theft. |

Finalizing And Maintaining Coverage

Once you choose a policy, finalize it. Provide any necessary documents. Pay the premium to start your coverage.

- Sign the policy agreement.

- Submit your driver’s license and vehicle registration.

- Pay the initial premium.

Maintain your coverage by paying premiums on time. Review your policy annually. Make changes if needed.

Remember, keeping your insurance active is crucial. It keeps you legal and protected on the road.

Dealing With Accidents And Claims

Accidents can be stressful. Knowing the steps to handle claims helps. This section covers the immediate steps after an accident, how to file a claim, and navigating the claims process.

Immediate Steps After An Accident

First, ensure safety. Move to a safe area if possible. Call emergency services if needed. Exchange information with the other driver. This includes names, contact numbers, and insurance details. Take photos of the accident scene. This helps with your claim later.

- Ensure safety

- Call emergency services

- Exchange information

- Take photos

Filing A Claim

Notify your insurance company soon. Provide them with accident details. Include photos and contact information. Your insurer will guide you through the next steps.

- Notify your insurer

- Provide accident details

- Include photos and contact info

Navigating The Claims Process

Cooperate with your insurance adjuster. They will inspect the damage. You may need to get repair estimates. Keep all receipts and documents. This helps with reimbursement. Follow up regularly with your insurer. Ensure your claim progresses smoothly.

| Step | Action |

|---|---|

| 1 | Cooperate with adjuster |

| 2 | Get repair estimates |

| 3 | Keep all receipts |

| 4 | Follow up with insurer |

Credit: www.carinsurancelist.com

Faqs On Virginia Car Insurance

Understanding car insurance in Virginia can be confusing. This section answers the most common questions about car insurance requirements in Virginia. We’ll cover minimum legal requirements, recommended coverage, how to switch insurance providers, and the impact of traffic violations on premiums.

Minimum Legal Requirements Vs. Recommended Coverage

Virginia mandates minimum car insurance coverage. The required limits are:

- Bodily Injury Liability: $30,000 per person and $60,000 per accident.

- Property Damage Liability: $20,000 per accident.

- Uninsured Motorist Coverage: Same as bodily injury liability limits.

- Underinsured Motorist Coverage: Same as bodily injury liability limits.

While these are the minimum legal requirements, experts recommend higher coverage. It ensures better protection. Consider purchasing:

- Comprehensive Coverage: Covers non-collision incidents like theft or natural disasters.

- Collision Coverage: Pays for damages to your car in an accident.

- Medical Payments Coverage: Helps cover medical expenses after an accident.

How To Switch Insurance Providers

Switching insurance providers in Virginia is straightforward. Follow these steps:

- Shop around and compare quotes from different insurers.

- Select the new provider and finalize your policy.

- Contact your current insurer to cancel your existing policy.

- Ensure the new policy starts before the old one ends to avoid a lapse in coverage.

It’s important to inform the Virginia Department of Motor Vehicles (DMV) about the switch. This ensures your new policy is registered with the state.

Impact Of Traffic Violations On Premiums

Traffic violations can significantly impact your car insurance premiums. Common violations include:

- Speeding tickets

- Running red lights

- DUI/DWI offenses

Each violation adds points to your driving record. More points can lead to higher premiums. Here’s a brief table showing the impact:

| Violation Type | Average Premium Increase |

|---|---|

| Speeding | 20%-30% |

| Running a Red Light | 25%-35% |

| DUI/DWI | 50%-80% |

Maintaining a clean driving record is crucial. It helps in keeping insurance premiums low.

Frequently Asked Questions

What Are The Two Types Of Insurance That Are Required By Virginia Law?

Virginia law requires two types of insurance: liability insurance and uninsured motorist coverage. Liability insurance covers damages you cause to others, while uninsured motorist coverage protects you if an uninsured driver hits you.

Does Virginia Have Mandatory Car Insurance?

Yes, Virginia requires mandatory car insurance. Drivers must carry minimum liability coverage for bodily injury and property damage.

What Type Of Insurance Is Required For You To Drive A Car In Virginia?

Virginia requires liability insurance to drive a car. Minimum coverage includes $25,000 for injury or death per person, $50,000 per accident, and $20,000 for property damage.

Is Uninsured Motorist Coverage Required In Virginia?

Uninsured motorist coverage is not mandatory in Virginia. However, drivers must pay a $500 fee if they opt out.

Conclusion

Understanding Virginia’s car insurance requirements ensures you’re adequately covered on the road. Maintain liability insurance to stay compliant. Consider additional coverage for extra protection. Regularly review your policy to meet your needs. Stay informed and drive safely in Virginia.