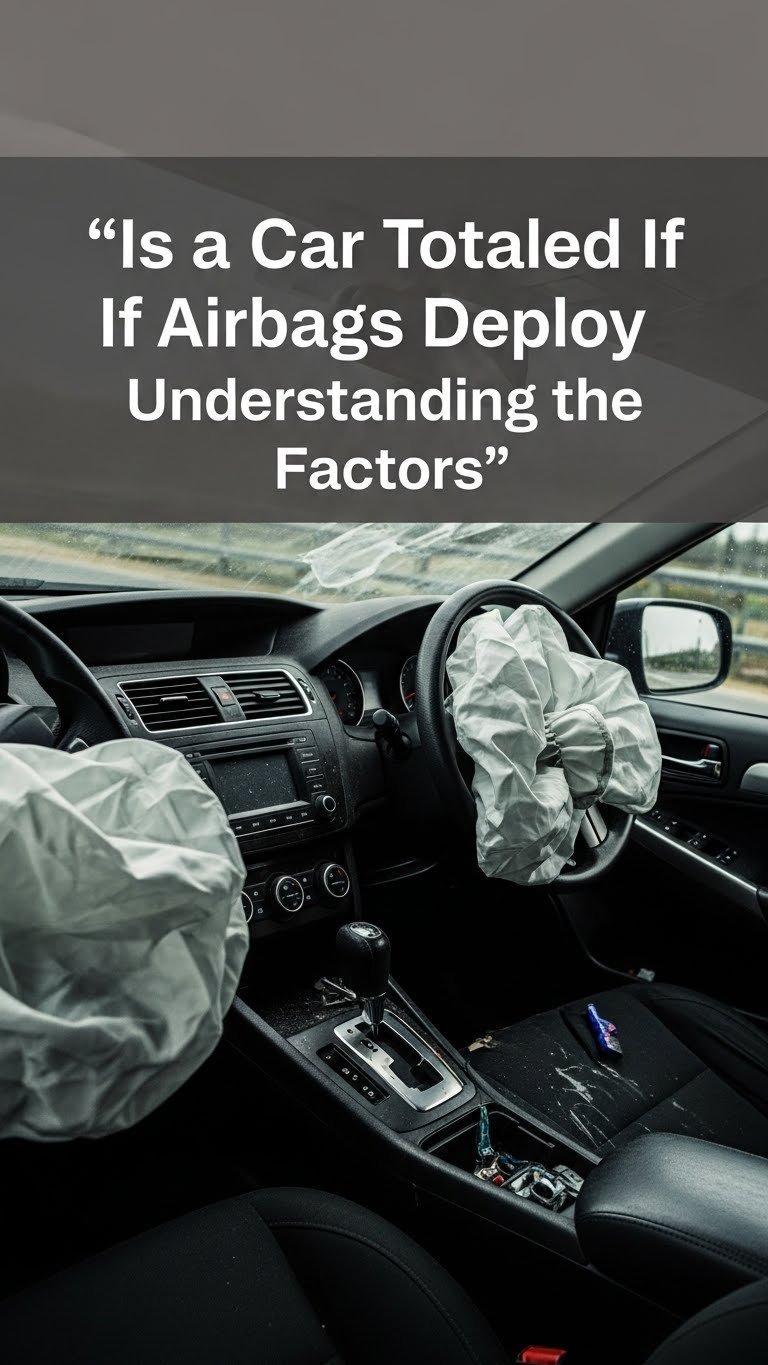

Worried about your car being totaled just because the airbags deployed? You’re not alone; it’s a stressful situation filled with confusing insurance terms. Many drivers assume deployed airbags automatically mean a total loss.

No, a car is not automatically considered totaled just because the airbags deployed. An insurance company declares a car a total loss only when the cost to repair it—including replacing the airbags and fixing all other damage—is more than the car’s pre-accident value, according to state-specific thresholds. Airbag deployment simply signals a significant impact that requires a thorough damage assessment.

This guide is based on current insurance industry guidelines and professional damage assessments. We’ll break down exactly how insurers make this decision. You will learn the specific formulas and factors that determine whether your car is repaired or declared a total loss.

Key Facts

- Not Automatic: Airbag deployment does not automatically mean a car is totaled; it’s a common misconception. The final decision is always financial.

- The Core Formula: A car is declared a total loss only when the estimated repair cost exceeds a certain percentage of its pre-accident actual cash value (ACV).

- High Cost of Replacement: Replacing a full airbag system is a major expense, typically ranging from $2,000 to over $8,000, which significantly impacts the repair estimate.

- State Laws Matter: Each state has a “Total Loss Threshold” (TLT), a percentage (often 70% to 100%) that dictates when an insurer must declare a vehicle a total loss.

- Structural Damage is Critical: While airbags are costly, damage to the vehicle’s frame or unibody is often a more definitive factor in a total loss decision due to safety concerns and repair complexity.

Is a Car Totaled If Airbags Deploy?

The short answer is no, but it is a major factor that significantly increases the chances. A car [digital object representing a wheeled motor vehicle] is only declared a total loss when the insurance company determines it is “beyond economic repair.” This happens when the total cost of repairs gets too close to the vehicle’s actual cash value (ACV) before the accident. Airbag deployment is a red flag for insurers because their replacement is one of the most expensive parts of a collision repair.

Think of airbag deployment as a strong signal of a significant impact. It tells the insurance adjuster that they need to perform a comprehensive damage assessment. The cost to replace the airbags themselves, combined with the cost to fix the collision damage that caused them to deploy, often pushes the total repair bill over the edge.

So, while the airbags going off don’t seal your car’s fate, they start a calculation that often leads to a total loss declaration. So, what are the factors that really matter to your insurer? Let’s break down the official criteria they use.

What Key Factors Do Insurance Companies Use to Determine a Total Loss?

Insurance companies [organizations that provide financial protection] use four primary factors to determine if a car is a total loss. This decision is not subjective; it’s a data-driven process based on automotive industry standards and specific financial calculations. An insurance claims adjuster performs a professional damage assessment to gather the necessary data for this evaluation.

Here are the four pillars of a total loss decision:

- Total Repair Cost: This is the complete estimated cost to restore the vehicle to its exact pre-accident condition, including parts, labor, and diagnostics.

- Actual Cash Value (ACV): This represents the market value of your car—what it was worth the moment before the accident happened.

- Damage Severity: This involves the type and extent of the damage, with special attention paid to structural or frame damage that could compromise the vehicle’s safety.

- State-Specific Laws: Your state government sets a “Total Loss Threshold” (TLT), which is a percentage that dictates when a vehicle must be declared a total loss.

How Is Total Repair Cost Estimated?

The total repair cost estimate includes much more than just the visible damage. After an airbag deployment, the estimate is a complex calculation that covers every component needed to make the vehicle safe and whole again. Think of it like a medical bill; it’s not just the main procedure but all the associated tests and supplies that add up.

A comprehensive repair estimate will include:

* Airbag System Components: This isn’t just the bags themselves. It includes all deployed airbag modules, the central airbag control module (the “brain”), all triggered crash sensors, and often the seatbelt pretensioners, which are designed to work in tandem with the airbags.

* Cosmetic and Collision Damage: This covers the parts damaged in the initial impact, such as bumpers, fenders, headlights, the steering wheel, and the dashboard, which often cracks or shatters when the passenger airbag deploys.

* Structural Repairs: This is the most critical and expensive part. If the vehicle’s frame or unibody is bent or compromised, the labor and equipment required to fix it are substantial.

* Labor, Paint & Diagnostics: This includes the certified labor hours to perform all installations and repairs, the cost of paint and materials to match the factory finish, and the crucial step of recalibrating any Advanced Driver-Assistance Systems (ADAS) like cameras and sensors that were disturbed during the repair.

How Is a Car’s Actual Cash Value (ACV) Determined?

A car’s Actual Cash Value (ACV) is its fair market value right before the crash occurred. It is crucial to understand that ACV is not what you paid for the car, what a new one costs, or what you still owe on your loan. It’s the replacement cost minus depreciation.

Insurers determine ACV by using a combination of resources and data points, including:

* Vehicle Specifics: The year, make, model, trim level, and factory options.

* Mileage: Lower mileage generally increases value.

* Overall Condition: The pre-accident condition, including any prior damage, wear and tear, or exceptional maintenance.

* Local Market Data: Recent sales prices of comparable vehicles in your geographic area. Adjusters use valuation tools like the NADA guide and other internal databases to find these comparable sales.

Pro Tip: Gather your own evidence to support a higher ACV. Collect recent maintenance records, receipts for new tires or parts, and any photos you have of the car in good condition before the accident. This documentation can help you negotiate if you feel the initial offer is too low.

How Much Does It Cost to Replace Deployed Airbags?

Replacing deployed airbags can cost anywhere from $2,000 to $8,000 or more. This high price is often the primary reason a vehicle, especially an older one, is declared a total loss. The cost is not for the “bag” alone but for the entire intricate safety system that must be replaced and recertified to function correctly in a future crash.

The final price depends heavily on the car’s make and model, the number of airbags that deployed, and local labor rates. According to NHTSA safety regulations, this work must be performed by a certified repair technician using Original Equipment Manufacturer (OEM) parts to ensure safety.

Here is a breakdown of the estimated costs for various components of the airbag system:

| Component | Estimated Cost Range (USD) | Why It’s Necessary |

|---|---|---|

| Driver-Side Airbag | $400 – $1,200 | Deployed airbag module must be replaced. |

| Passenger-Side Airbag | $600 – $1,500 | Often requires dashboard replacement as well. |

| Side/Curtain Airbags | $500 – $1,000 per side | Protects from side impacts; located in seats or roofline. |

| Airbag Control Module (SRS Unit) | $500 – $1,200 | The “brain” of the system; must be reset or replaced. |

| Crash Sensors | $100 – $300 each | One-time use; must be replaced after triggering. |

| Seatbelt Pretensioners | $200 – $500 per seatbelt | Often deploy with airbags and must be replaced. |

| Labor & Diagnostics | $500 – $2,000+ | Certified labor to install and recalibrate the system. |

⚠ CAUTION: Never use used, salvaged, or counterfeit airbags. These parts are unreliable and extremely dangerous. They may fail to deploy when needed or deploy unexpectedly, causing serious injury or death. Always insist on new OEM parts from a certified repair facility.

How Do Insurers Calculate if a Car Is “Beyond Economic Repair”?

Insurers use a “Total Loss Formula” to make a final, data-driven decision. Once the adjuster has the estimated repair cost and the car’s ACV, they plug these numbers into a formula. If the numbers cross a certain threshold, the car is declared a total loss. There are two primary methods used.

The most fundamental calculation is the Total Loss Formula (TLF). This is the true economic basis for the decision.

A car is considered a total loss if:

(Cost to Repair) + (Salvage Value) > (Actual Cash Value)

In this formula, “Salvage Value” is the amount the insurance company can get by selling your damaged car to a salvage yard. If the cost to fix your car plus the money they’d lose by not selling it for salvage is more than what your car was worth, it’s an economic loss for them to repair it.

Many states have simplified this into a Total Loss Threshold (TLT). This is a specific percentage set by state law.

A car is considered a total loss if:

(Cost to Repair) > (State TLT % * Actual Cash Value)

For example, if your car’s ACV is $10,000 and you live in a state with a 75% TLT, your car will be automatically totaled if the repair estimate exceeds $7,500.

Here are a few examples of state thresholds as of 2026:

| State | Total Loss Threshold (Example) |

|---|---|

| Texas | 100% of ACV |

| New York | 75% of ACV |

| Colorado | 100% of ACV (based on formula) |

| Iowa | 70% of ACV |

What Happens After Your Car Is Declared a Total Loss?

Once your car is declared a total loss, a clear, step-by-step settlement process begins. This process is designed to compensate you for the value of your lost vehicle. Understanding these steps can help you navigate the situation with confidence.

Here is what you can expect:

- Settlement Offer: Your insurance company will formally present you with a settlement offer. This offer will be for the car’s determined Actual Cash Value (ACV), minus the amount of your collision deductible.

- Negotiation: You do not have to accept the first offer. If you have gathered evidence (like maintenance records or comparable vehicle sales ads) suggesting your car’s ACV is higher, you can present this to your adjuster and negotiate for a fairer settlement.

- Lienholder Payout: If you have an auto loan or lease, the insurance company is legally required to pay the lienholder (your bank or finance company) first. The settlement check goes directly to them to pay off your remaining loan balance.

- Ownership Transfer: You will need to sign over the car’s title to the insurance company. They will arrange to have the vehicle towed from your home or the repair shop. At this point, the insurer owns the car.

- Final Payout: If the settlement amount was greater than your loan balance, you will receive a check from the insurance company for the difference. If you owned the car outright, the full settlement (minus the deductible) comes to you.

What If You Have a Loan?

If you owe more on your loan than the car’s ACV (a situation known as being “upside-down”), the settlement check will go to the bank, but it won’t be enough to cover the full loan. You will still be responsible for paying the remaining balance. This is where Gap Insurance is crucial; if you have it, it will pay off that “gap” for you.

Can You Keep the Car?

In most states, you have the option to keep your totaled vehicle. This is called “owner retention.” If you choose this, the insurer will pay you the ACV, minus your deductible, and also minus the car’s determined salvage value. You get to keep the car and the remaining cash, but the vehicle will be issued a “Salvage Title,” which makes it difficult to insure or sell in the future.

FAQs About Is a Car Totaled If Airbags Deploy

Can you drive a car after the airbags deploy?

It is extremely unsafe and often illegal to drive a car after the airbags have deployed. The deployed bags can obstruct your view, and more importantly, the entire supplemental restraint system (SRS) is now inactive, offering no protection in a subsequent crash. The car should be towed from the scene.

Do side airbags deploying total a car?

Not automatically, but it significantly increases the odds. Side and curtain airbags are expensive to replace, and their deployment often indicates a side-impact collision that may have caused structural damage to the car’s B-pillars or frame. The same total loss formula (repair cost vs. car value) applies.

Can a car be repaired after airbags deploy?

Yes, a car can almost always be technically repaired after airbag deployment. The real question is whether it’s economically feasible. If the total cost of replacing the airbag system and fixing all collision damage is less than the car’s value, it can and will be repaired.

What if airbags deploy but there’s only minor visible damage?

This is a common scenario, especially with low-speed impacts on modern cars. Even with minor bumper damage, the cost to replace the deployed airbags, sensors, and control module can easily run into thousands of dollars. On an older or lower-value car, this cost alone can be enough to trigger a total loss declaration.

Is a car totaled if the airbags deploy in a low-speed collision?

It is possible, particularly for older vehicles with lower ACV. A low-speed collision that is just forceful enough to trigger the airbags can result in a repair bill of $3,000-$5,000 for the airbag system alone. If the car’s value is only $6,000, it’s very likely to be totaled.

Can a car be totaled without the airbags deploying?

Yes, absolutely. A car can suffer extensive structural or flood damage that makes it unsafe or too expensive to repair, even if the impact wasn’t of the specific type to trigger airbag deployment. The total loss decision is always about the repair cost versus the vehicle’s value, not just the airbags.

Will my car insurance premium increase if airbags deploy and it’s totaled?

Your premium will likely increase at renewal if you were at fault for the accident. A total loss claim is a major claim. However, if the accident was not your fault, your rates should not be affected, as your insurer will typically recover the costs from the at-fault party’s insurance.

Why are new cars more likely to be totaled with deployed airbags?

New cars are packed with complex electronics and safety systems (ADAS). After an airbag deployment, it’s not just the bags that need replacing, but numerous sensors, cameras, and computers may need to be recalibrated or replaced, which is a highly specialized and expensive process. This drives repair costs up dramatically.

Can I keep my car if it’s totaled by the insurance company?

In most states, yes, you have the option to “owner-retain” the salvage. The insurance company will pay you the ACV minus your deductible and also minus the car’s “salvage value” (what they would have gotten for it at auction). You will then receive the car back with a salvage title.

How does my deductible affect a total loss payout?

Your deductible is subtracted from the final settlement amount. If your car’s ACV is determined to be $15,000 and you have a $500 deductible, the insurance company’s base payout will be $14,500. This amount would then go to your lienholder first, if you have one.

Key Takeaways: Airbag Deployment & Total Loss Summary

- Deployment Isn’t Automatic: The single most important takeaway is that deployed airbags do not automatically total a car. The decision is purely financial.

- It’s All About the Formula: A car is totaled when the

repair costapproaches or exceeds itsactual cash value (ACV), based on state-specifictotal loss thresholds. - Airbag Costs Are a Major Factor: Replacing the full airbag system is expensive ($2,000-$8,000+), often pushing the repair estimate into the total-loss zone, especially for older cars.

- Value is Key: Insurers determine your car’s pre-accident market value (ACV) using guides like NADA and local market data; this number is the benchmark for the entire decision.

- Structural Damage Matters More: While airbags are costly, significant damage to the car’s frame or unibody is a more serious indicator of a likely total loss due to safety and repair complexity.

- Know the Process: After a total loss is declared, the insurer pays you the ACV (minus your deductible), pays your lienholder first, and takes possession of the car, which then gets a salvage title.

- You Have Options: You can negotiate the ACV settlement with your insurer and, in most cases, choose to keep the totaled vehicle if you’re willing to accept a reduced payout.

Final Thoughts on Navigating a Potential Total Loss

Navigating the aftermath of a car accident is never easy, but understanding the process is the best way to reduce stress and ensure a fair outcome. Remember that when it comes to a total loss, the decision is driven by data, not just the dramatic event of an airbag deployment.

By understanding the key factors—repair cost, actual cash value, damage severity, and state laws—you are no longer a passive observer. You are an informed participant in the process. This knowledge empowers you to have productive conversations with your insurance adjuster, negotiate your settlement effectively, and make the best decision for your financial situation. What has been your experience with this process?

![What Car Is Chevy Bringing Back in [year]? New Lineup Revealed 9 What Car Is Chevy Bringing Back in [year]? New Lineup Revealed](https://carxplorer.com/wp-content/uploads/2026/01/What-Car-Is-Chevy-Bringing-Back-in-year-New-Lineup-Revealed-1-1-60x60.jpg)