Ready to break into the exclusive, business-to-business side of the automotive industry? You’ve likely heard about the potential of wholesale dealing but are facing the complex maze of licensing requirements, state-specific rules, and financial prerequisites. This guide is engineered to eliminate that confusion, providing a clear, step-by-step roadmap to navigate the entire process.

To successfully become a wholesale car dealer, you must methodically complete a series of legal and administrative steps. This includes legally registering your business entity, securing a compliant location, obtaining a surety bond, completing the state-specific license application with any required education, paying all fees, and passing a final background check and inspection.

Leveraging a detailed analysis of state regulations and industry data, this guide unpacks the proven process and critical insights needed to effectively learn how to be a wholesale car dealer. We will cover everything from the foundational legal work to the specific financial hurdles you’ll need to clear, ensuring you are fully prepared to launch your wholesale auto business.

Key Facts

- Business-to-Business Model: A wholesale car dealer operates exclusively by selling vehicles to other licensed dealerships and at dealer-only auctions; they are legally prohibited from selling directly to the general public.

- Significant Location Flexibility: Unlike retail operations, wholesale dealers often do not need a public display lot. Data from states like Arizona shows that it’s even possible to operate from a residence, drastically reducing overhead costs.

- Mandatory Education in Some States: Aspiring dealers must be aware of state-specific educational prerequisites. For example, California requires a dealer education program and a used dealer test, while Colorado mandates a pre-licensing course and a mastery exam.

- Credit Score is a Key Cost Factor: The annual premium for your required auto dealer surety bond is directly influenced by your personal credit score. A higher credit score can save you hundreds or even thousands of dollars per year on this essential insurance.

- Stringent Financial Vetting: Certain states impose strict financial requirements. Colorado, for instance, requires wholesale dealer applicants to demonstrate a minimum net worth of $100,000 and have a Vantage credit score of 701 or higher to qualify for a license.

What Is a Wholesale Car Dealer & Why Become One?

A wholesale car dealer primarily buys vehicles from auctions or manufacturers and sells them exclusively to other licensed dealerships, profiting from the price difference. Unlike retail dealers, they cannot sell to the public. This business-to-business (B2B) model is the core distinction that shapes every aspect of the licensing process, often resulting in less stringent requirements compared to a public-facing retail operation.

The primary function of a how to be a wholesale car dealer is to act as a crucial link in the automotive supply chain. They acquire inventory, perhaps in bulk from manufacturers or by purchasing trade-ins and overstock from retail dealerships, and then resell these vehicles to other dealers who need to fill their lots. This B2B focus creates a different set of advantages and operational realities.

To understand the business case, it’s essential to see the direct comparison between a wholesale and retail dealer:

- Wholesale Dealer: Sells only to other licensed dealers. Does not need a public-facing car lot. Typically has lower overhead and fewer zoning restrictions. Focuses on volume and rapid turnover of inventory.

- Retail Dealer: Sells directly to the public. Requires a consumer-friendly display lot and showroom. Faces more stringent regulations regarding consumer protection, financing, and advertising. Manages customer service, test drives, and retail financing.

One of the most significant financial advantages of securing a wholesale dealer license is the tax implication at the time of purchase.

A key benefit for US businesses with a wholesale license is the exemption from sales tax when purchasing vehicles. This is because the sales tax is ultimately paid by the end consumer when they buy the car from a retail dealership.

Ready to operate in the B2B auto world without the complexities of a public-facing lot? Let’s get started on the exact steps you need to take to learn how to be a wholesale car dealer.

Step 1: Legally Register Your Business Entity

Action: Formally establish your business as a legal entity by registering with your state’s Secretary of State and filing the necessary organizational documents for your chosen structure (e.g., LLC, Corporation).

Before you can even think about a dealer license, you must first create a legitimate business for the state to license. This is a foundational legal step that separates your personal identity from your professional operations. This process typically involves a few key actions.

- Choose Your Business Structure: You’ll need to decide on the legal structure of your company. Common choices include a Limited Liability Company (LLC) or a Corporation. An LLC is often favored by small businesses for its blend of liability protection and operational flexibility. A Corporation offers robust liability protection but comes with more formal compliance requirements.

- Register with the Secretary of State: You must register your business entity with the Secretary of State (or equivalent office) in the state where you plan to operate. This involves filing formal documents, such as the Articles of Organization for an LLC or Articles of Incorporation for a corporation.

- Register Your Trade Name: If you plan to operate under a name different from your legal business name (e.g., “Main Street Motors” instead of “J. Smith Enterprises, LLC”), you must also register this “Doing Business As” (DBA) or trade name.

This step is a universal legal requirement. Keep in mind that if you intend to operate your wholesale business in multiple states, you will likely need to complete this registration process in each state according to its specific regulations.

Pro Tip: Check your chosen business name’s availability on your state’s Secretary of State website before filing to avoid delays.

Step 2: Secure a Compliant Business Location

Action: Find a physical location that meets your state’s requirements. This may be a simple office or even a residence, as a public display lot is often not required for wholesale-only dealers.

One of the biggest advantages of learning how to be a wholesale car dealer is the flexibility in location requirements. Because you won’t be selling to the public, the need for a large, expensive, and highly visible display lot is often eliminated. This dramatically lowers the barrier to entry and reduces monthly overhead.

However, “no display lot” does not mean “no requirements.” States still mandate that you have an established place of business. The specific rules vary, but generally, you’ll need to provide proof of a location that meets certain criteria:

- A Dedicated Office Space: The location must be an enclosed office where you can securely store your business records.

- Basic Office Furnishings: States typically require the office to contain, at a minimum, a desk and chairs.

- Essential Utilities: You must have functional utilities, including internet access and a dedicated business phone number.

The flexibility can be substantial depending on your state.

For example, wholesale dealers in Arizona are permitted to operate from a residence, offering a significant cost-saving opportunity. In contrast, a state like North Carolina may mandate a specific minimum office size, such as 96 square feet.

Quick Fact: The flexibility in location is one of the biggest cost-savers for new wholesale dealers compared to their retail counterparts.

Before signing a lease or designating a home office, it’s critical to understand local rules. You must ensure your chosen location complies with local “zoning ordinances,” which are city or county rules that dictate what types of business activities are allowed in specific areas. A quick call or visit to your local planning and zoning department can confirm if a wholesale auto business is permitted at your prospective address. This proactive check can save you from a major compliance headache down the road.

Step 3: Complete the Wholesale Dealer License Application

Action: Obtain the official wholesale dealer license application from your state’s licensing authority (e.g., DMV), and complete any required pre-licensing education or tests before submission.

With your business entity registered and your location secured, it’s time to tackle the core paperwork. The dealer license application is a comprehensive document that serves as your formal request to operate. You will obtain this application from your state’s Department of Motor Vehicles (DMV) or an equivalent licensing authority.

The process of completing the application is more than just filling in blanks. It’s a structured procedure that often includes prerequisite steps.

- Obtain the Correct Application: First, ensure you have the specific application for a wholesale-only dealer. The forms and requirements can differ significantly from retail dealer applications.

- Complete Educational Requirements: Many states now mandate pre-licensing education to ensure dealers understand the relevant laws and regulations. For instance, data shows that California requires applicants to get a Certificate of Completion from a Dealer Education Program and pass a used dealer test. Similarly, Colorado requires a mastery exam for its wholesale applicants.

- Fill Out All Sections Accurately: Provide all requested personal and business information with meticulous accuracy. Any inconsistencies or misstatements can lead to delays or outright denial of your application. The form will typically ask for background information related to your financial and criminal history.

- Gather Supporting Documents: The application is rarely a stand-alone document. You will need to submit it as part of a larger package with other required paperwork.

Pro Tip: Don’t just complete the education program—actively learn. The information can save you from costly compliance mistakes down the road.

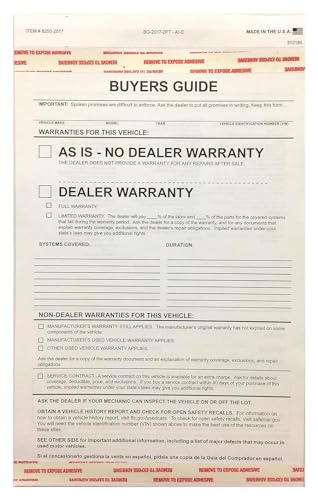

To ensure a smooth submission, prepare a checklist of commonly required documents. While this varies by state, your application package will likely need to include:

- Proof of business registration (Articles of Incorporation/Organization)

- A copy of your lease agreement or proof of property ownership

- Photographs of your business location, including any required signage

- The original copy of your surety bond (covered in the next step)

- Receipts for all paid fees

- Your Certificate of Completion from any required education courses

Step 4: Obtain a Wholesale Dealer Surety Bond

Action: Purchase a surety bond for the amount required by your state. Your personal credit score will be the primary factor in determining the annual premium you pay for this bond.

Nearly every state requires auto dealers, including wholesalers, to obtain a surety bond. A wholesale dealer surety bond is a three-party contract that acts as a financial guarantee. It ensures that you will operate your business ethically and in compliance with all state laws.

Understanding the function and cost of a surety bond is a critical financial planning step in your journey of learning how to be a wholesale car dealer.

- What it is: A surety bond is a form of insurance that protects your customers (in this case, other dealers) and the state from financial loss resulting from fraudulent practices on your part.

- Who it protects: The bond is not for your protection. It exists to provide a financial remedy for others if you violate the terms of your license.

- How cost is determined: You don’t pay the full bond amount. You pay an annual premium, which is a percentage of the total bond amount. This percentage is heavily influenced by your personal credit score. A strong credit history results in a lower premium.

The required bond amount varies dramatically by state. For example, data shows that Colorado requires a $50,000 surety bond for motor vehicle wholesalers. The actual out-of-pocket cost, or “premium,” for this bond could range from 1% to 15% of that amount.

For instance, on a $50,000 bond, an applicant with an excellent credit score might pay a premium of just 1%, or $500 per year. Conversely, an applicant with a poor credit history might be quoted a premium of 10%, costing them $5,000 per year for the same bond coverage.

Think of the surety bond as your business’s insurance policy for ethical conduct. A good credit score is your best tool for keeping this cost low.

Step 5: Pay All Fees and Pass Final Inspections

Action: Submit all required fees, consent to and pass a background check (which may include financial and criminal history), and prepare your business location for a state inspection.

You are now in the final stage of the application process. This step involves settling all financial obligations and clearing the final verification hurdles before your license can be issued. This is where your meticulous preparation pays off.

First, you’ll need to pay all associated government fees. These are non-negotiable and vary widely from one state to another. It’s important to distinguish between the different types:

- Application Fee: A one-time, often non-refundable fee for processing your paperwork.

- Licensing Fee: The recurring cost to maintain your license, which may be due annually or biennially.

- Dealer Plate Fees: The cost for any special dealer license plates you require for transporting vehicles.

A comparison of fees shows just how much they can differ:

| State | Application Fee |

|---|---|

| California | $175 |

| Maryland | $225 |

Next, you will undergo a formal background check. This is a standard procedure to verify your fitness to hold a professional license. The process often involves fingerprinting and a review of your criminal history. Some states also conduct a financial background check. For example, to become a wholesale car dealer in Colorado, an applicant must have a Vantage credit score of at least 701 and provide explanations for any derogatory marks on their credit report.

Finally, prepare for an inspection. A representative from the DMV or state licensing authority may visit your business location to verify that it meets all requirements. They will check for proper signage, a secure office for records, and general compliance with the rules you learned in your pre-licensing course.

This is the final stretch. Meticulous paperwork and a clean, compliant office space are key to sailing through this last step.

To ensure you’re ready, use this final submission checklist:

* Have all application forms been filled out completely and signed?

* Are all supporting documents (lease, photos, bond) included?

* Have you enclosed payment for all required fees?

* Is your office location clean, organized, and ready for inspection?

* Have you completed the fingerprinting and background check authorization?

Navigating State-Specific Wholesale Dealer Requirements

It is critical to research your specific state’s laws, as requirements vary dramatically. Key differences can include minimum net worth, credit scores, education, insurance, and specific permits.

While the five steps above provide a general framework for how to be a wholesale car dealer, the devil is in the details—and the details are dictated by your state. Assuming the process is the same everywhere is the fastest way to have your application rejected. Below are concrete examples from available data that illustrate just how different the requirements can be.

California Requirements

California has a highly structured process with a strong emphasis on education and tax compliance.

* Education: Applicants must provide a Certificate of Completion from an approved Dealer Education Program.

* Testing: You must show proof of successfully passing the state’s used dealer test.

* Tax Permit: A copy of your California Department of Tax and Fee Administration (CDTFA) Resale Permit is required.

* Location Verification: You must submit detailed photographs of your business location as part of the application package.

Colorado Requirements

Colorado is known for its stringent financial and character vetting processes.

* Net Worth: Applicants must prove they have a minimum net worth of at least $100,000.

* Credit Score: A Vantage credit score of 701 or higher is mandated.

* Business Plan: You are required to submit a detailed business plan with your application.

* Background Scrutiny: The state has specific rules regarding past felony convictions and will deny applications with material misstatements.

Maryland Requirements

Maryland’s rules include specific operational allowances and restrictions.

* Location: An approved office location is required.

* Sourcing Vehicles: Wholesale dealers in Maryland are permitted to buy vehicles from the general public.

* Sales Restrictions: However, they are strictly prohibited from selling any vehicles to the retail public.

Tennessee Requirements

Tennessee emphasizes a combination of physical location standards and financial disclosures.

* Established Business: You must have an established place of business with proper signage.

* Insurance: Proof of liability insurance is a mandatory requirement.

* Financial Disclosure: A financial background disclosure must be submitted with the application.

* Zoning: A zoning compliance letter from your local municipality is required to prove your location is properly zoned.

Which of these state requirements seems the most challenging? The key is always to check your specific state’s DMV or licensing authority website for the most current checklist.

To ensure your business operates smoothly, having the right supplies and tools is essential, from diagnostic equipment for vehicle inspections to organizational supplies for your office. Investing in quality equipment from the start can streamline your operations and help maintain compliance.

FAQs About Becoming a Wholesale Car Dealer

Do wholesale car dealers make money?

Yes, wholesale car dealers make money by capitalizing on price differentials. They acquire vehicles at lower costs from sources like dealer-only auctions or dealership trade-ins and then resell them for a profit to other licensed retail dealers who need inventory for their lots. The business model is based on volume and efficient turnover.

Can a wholesale dealer sell cars to the public?

No, this is the most critical distinction. A licensed wholesale dealer is strictly prohibited from selling vehicles to the general public. Their license only permits them to conduct business with other licensed motor vehicle dealers. Violating this rule can result in severe penalties, including the loss of your dealer license.

Is it worth it to get a wholesale license?

For many, it is worth it. The primary benefits include gaining access to exclusive dealer-only auto auctions where inventory is much cheaper, and being exempt from paying sales tax at the time of purchasing vehicles. This allows you to operate with lower overhead compared to simply buying and selling cars privately.

How much does it cost to get a dealer license in a state like Arizona?

While the total cost varies, the core components in Arizona, based on available data, include fees for a $25,000 surety bond (the premium for which depends on your credit), a non-refundable application filing fee which can be as low as $15, and other administrative costs. You must check with the Arizona Department of Transportation for the most current and complete fee schedule.

Can you finance a car bought from a wholesale source?

Financing is typically a retail transaction offered to consumers. Wholesale transactions are business-to-business (B2B). As a wholesale dealer, you would typically purchase vehicles using cash, a business line of credit, or a specialized “floor plan” financing arrangement designed specifically for car dealers to fund their inventory.

What are the main benefits of having a wholesale license over just buying and selling cars?

The two main benefits are access and tax advantages. A wholesale license grants you legal access to dealer-only auctions, which are closed to the public and offer the best vehicle pricing. Secondly, as a licensed dealer, you are exempt from paying sales tax on the vehicles you purchase for inventory, which is a significant cost saving.

Your Next Steps to Becoming a Licensed Wholesale Dealer

You now have the complete, data-driven blueprint for how to be a wholesale car dealer. The path involves a series of logical, sequential steps, from establishing your legal business foundation to clearing the final state-mandated inspections. While the process is detailed, it is entirely manageable with careful planning and a commitment to following the rules of your specific state. Success hinges on your meticulous attention to detail during the application process and your understanding that state regulations are the ultimate authority.

By following this guide, you can confidently navigate the licensing maze and position yourself to enter the profitable B2B automotive marketplace.

- Verify State Requirements: Your immediate next step is to visit the official website of your state’s DMV or licensing authority. Find their most current wholesale dealer application packet and checklist.

- Prepare Financially: Assess your finances. Ensure you have the capital for all fees, the surety bond premium, and any location-related costs. If your state has a net worth requirement, begin gathering the necessary documentation.

- Be Meticulous With Paperwork: Start organizing your documents now. Create a folder for your business registration, lease agreement, and any other required paperwork so you are ready when it’s time to submit your application.

Your path to becoming a wholesale car dealer starts now. The most important first action you can take is visiting your state’s official DMV or licensing authority website.

Last update on 2026-03-04 / Affiliate links / Images from Amazon Product Advertising API

![How to Start a Car Lot With No Money Zero Capital Guide [year] 19 How to Start a Car Lot With No Money Zero Capital Guide [year]](https://i0.wp.com/carxplorer.com/wp-content/uploads/2026/03/How-to-Start-a-Car-Lot-With-No-Money-Zero-Capital-Guide-year-2.jpg?resize=60%2C60&ssl=1)