Your car needs significant repairs, and the thought of trading it in feels daunting. Will a dealership even consider it? The core pain point is the fear of being rejected or, worse, financially exploited for a vehicle with known issues.

Yes, you can absolutely trade in a car that needs repairs. Dealerships often prefer taking trade-ins with repair needs because they possess a significant cost advantage over private sellers when performing those repairs. Leveraging tested frameworks and data-driven insights, this guide will empower you to navigate this complex transaction and minimize your financial loss.

Key Facts

- Dealer Cost Advantage: Dealerships typically repair cars for 30-50% less than retail mechanics, leveraging wholesale parts and labor rates.

- Repair Deduction Process: The trade-in deduction for repairs is based on the dealer’s wholesale reconditioning cost, plus a risk reserve for unforeseen issues.

- Minor Fixes Offer High ROI: Inexpensive fixes (under $500) like deep cleaning or small cosmetic repairs often yield a 200% ROI by improving subjective appraisal.

- Negative Equity Risk: Major repair deductions can push a car further into negative equity, where the loan balance exceeds the trade-in value, impacting your new loan.

- Disclosure is Crucial: Always provide written disclosure of known mechanical defects to avoid legal liability and build trust with the dealership.

Is It Possible To Trade In A Car That Needs Repairs, And How Do You Minimize Financial Loss?

Yes, you can trade in a car that needs repairs, but the trade-in value will be reduced by the dealer’s estimated wholesale reconditioning cost, plus a reserve for risk. This means the transaction is a matter of financial calculation, not outright refusal. Your mechanic quoted a $3,000 transmission repair. Are you doomed to lose that $3,000 on the trade-in? The answer is no, but you must understand dealer math first. Dealerships are not just in the business of selling new cars; they are also experts in asset liquidation and reconditioning, viewing every vehicle, even one needing significant work, as a potential asset.

Dealerships often prefer taking trade-ins with repair needs because they possess a significant cost advantage over private sellers when performing those repairs. They have access to wholesale parts pricing and internal, lower labor rates. This means a repair that costs you $3,000 at a retail mechanic might only cost the dealer $1,800 to fix. This substantial difference is their reconditioning advantage, which they factor into their trade-in offer.

The dealer’s reliance on the wholesale auction market (like Manheim) serves as the floor for their offer. They understand the “wholesale price” — the price other dealers would pay for your car in its current condition, with its defects. Your “Vehicle Trade-In” is seen as an “Asset Liquidation” opportunity. They’ll assess the “Car Repair” needs as a deduction factor from that wholesale value. Ultimately, the “Trade-In Value” is the wholesale price minus their estimated repair costs and a “Risk Reserve” (a buffer for unforeseen issues). This objective approach is what enables them to accept problem vehicles.

How Do Dealerships Calculate The Trade-In Deduction For Repairs? (The Dealer Math Revealed)

Dealerships calculate the trade-in deduction for repairs based on their internal, wholesale labor and parts rates, which are typically 30% to 50% lower than retail mechanic quotes, along with a financial buffer for risk. This is the essence of “Dealer Math,” a crucial concept for understanding your trade-in offer. For instance, if your mechanic quotes $4,000 for a repair, the dealer might only budget $2,400 for that same repair internally, immediately creating a $1,600 difference.

The trade-in deduction for “Car Repair” needs is a complex equation involving several “Entities & Attributes.” It’s not a simple line-for-line deduction of your mechanic’s quote. Instead, the “Dealership” focuses on their “Reconditioning Costs” — the actual expense they anticipate to bring the vehicle to a retail-ready state. This becomes a key “Trade-In Deduction” from the “Wholesale Car Value,” which is their baseline price.

Here’s a breakdown of how the deduction is calculated:

- Dealer’s Wholesale Repair Cost: This is the internal cost for the dealership to perform the repair, using their lower labor rates and wholesale parts. This is the primary component of the deduction.

- Risk Reserve: Dealerships include a financial buffer, typically 10-20% of the wholesale repair cost, to cover potential secondary issues found during mechanical triage or unexpected complications during repair. This is a critical factor often overlooked by private sellers.

- Profit Margin: While not a direct deduction for your car, the dealer’s desired “profit margin” on the eventual retail sale of your trade-in influences how aggressively they deduct for repairs. They need to ensure they can make money when they resell it.

The final trade-in deduction is calculated as the dealer’s wholesale repair cost plus a financial buffer, known as the risk reserve, to cover potential secondary issues found during mechanical triage. This approach allows them to price problem cars profitably.

How Do Major Repairs vs. Minor Repairs Affect Trade-In Value Differently?

Major repairs, such as those involving the engine or transmission, should almost always be avoided before a trade-in, whereas minor, high-ROI fixes can significantly improve your offer. This classification is key to maximizing your “Repair ROI.” The “Dealership” appraiser’s subjective view plays a role, but objective cost thresholds govern decisions.

Here’s a triage for your needed repairs:

- Major Repairs (Avoid Fixing): These are repairs exceeding $1,500-$2,000, affecting core powertrain (engine, transmission), safety systems (brakes, suspension), or frame integrity. Examples include blown engines, transmission failure, structural damage, or significant electrical issues valuation. The dealer’s wholesale cost advantage means you rarely recoup your retail repair investment. For instance, a $4,500 retail transmission repair might only be valued at $2,800 by the dealer, resulting in a $1,700 loss for you.

-

Mandatory Repairs (Fix Immediately): These are safety-critical issues such as severely worn brakes or tires that render the car unsafe or illegal to drive. While dealers will deduct for these, fixing them prevents further liability and ensures the car is even drivable for appraisal. Always address safety system failure deduction issues.

-

Minor Repairs (Consider Fixing for High ROI): These are typically inexpensive (under $500) and include deep cleaning, fixing small cosmetic damage like a cracked windshield or minor dents, or addressing inexpensive dashboard warning lights. Minor repairs, such as deep cleaning or addressing inexpensive dashboard warning lights, often yield a high return on investment because they improve the appraiser’s subjective view of overall vehicle care and condition. These simple fixes help move the car out of the “Poor” valuation category. The mistake of paying $300 to fix a faulty sensor only to find the dealer deducted the full $300 anyway because the root cause was worse is a common frustration. A good rule of thumb for fixing is never to spend more than $1,000 for non-mandatory repairs.

How Do You Determine The Best Financial Path: Fix and Sell, Or Trade-In As-Is?

To determine the optimal financial path for a damaged vehicle, you must compare the estimated Net Financial Outcome of three options: trading in as-is, fixing and trading, or fixing and selling privately, always factoring in the trade-in sales tax credit. This “Repair ROI Decision Framework” helps quantify your choices. You must consider the “Net Financial Outcome” and “Hassle Factor” (how much time and effort it will take).

Use the table below to analyze your specific circumstances—prioritize time or maximum profit—and let the numbers dictate your next move.

| Option | Net Financial Outcome (Estimate) | Hassle Factor (1=Low, 5=High) | Time Required | Risk Profile |

|---|---|---|---|---|

| Trade In As-Is | Wholesale Value – Deduction + Tax Savings | 1 | Same Day | Low (High Deduction Risk) |

| Fix and Trade In | Wholesale Value – Cost of Repair + Tax Savings | 3 | 3-5 Days | Medium (Loss of ROI Risk) |

| Fix and Sell Private | Retail Value – Cost of Repair | 5 | 2-4 Weeks | High (Liability & Time Risk) |

| Sell for Scrap/Parts | Salvage Value (Minimal) | 2 | 1-2 Days | Low (Guaranteed Minimum Payout) |

Here’s a step-by-step calculation to guide your decision:

- Calculate Trade-In As-Is: Get a preliminary trade-in offer from a dealership. Subtract any negative equity you carry. Add the estimated “Tax Savings” from your new car purchase (if your state allows the trade-in value to reduce the taxable amount). This is your initial “Net Financial Outcome.”

- Calculate Fix and Trade: Obtain an itemized mechanic’s quote (retail price) for all needed repairs. Subtract this repair cost from the initial as-is trade-in offer. Then add the “Tax Savings” as calculated above.

- Calculate Fix and Sell Privately: Estimate a realistic private party sale price for your car after repairs (this will be higher than trade-in value but lower than clean retail). Subtract the retail repair costs from this estimated sale price. This option doesn’t usually include tax savings on a new purchase, as it’s a separate transaction.

- Consider Selling for Scrap/Parts: For non-running or severely damaged vehicles, obtain a “Scrap Value” estimate from local yards. This offers minimal payout but zero hassle.

Generally, trading in as-is is financially advisable for major repairs due to the dealer’s wholesale cost advantage and the lower hassle factor associated with private sales of broken vehicles. For minor repairs, fixing and trading might yield a slightly better outcome.

What Are The Steps To Trading In A Car That Needs Work Successfully?

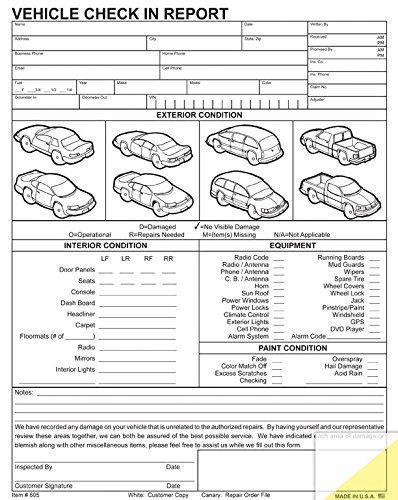

The successful trade-in of a damaged car relies on securing multiple independent repair estimates beforehand to establish an informed negotiation anchor against the dealer’s inevitable deduction. This structured approach, from preparation to negotiation, is crucial for maximizing your “Trade-In Value.” Now that you know the dealer saves 30-50% on parts and labor, why wouldn’t you challenge their initial $3,500 deduction?

Here are the six critical steps to follow:

- Get Independent Itemized Repair Quotes: Before setting foot in a dealership, visit 2-3 trusted independent mechanics. Ask for itemized repair estimates for all known issues. These quotes, providing the “Mechanic Repair Estimate” (retail cost), will be your primary negotiation leverage.

- Perform High-ROI Minor Repairs & Clean the Car: Address any safety-critical issues and complete inexpensive, high-impact fixes like a deep clean, a fresh oil change, new wiper blades, or resolving minor dashboard warning lights. A well-maintained appearance improves the appraiser’s subjective assessment of overall care.

- Obtain a Baseline Value from Online Tools: Use online car valuation tools (KBB, Edmunds, NADA) and accurately input your car’s condition, including known defects. This provides a realistic “Wholesale Car Value” range to set your expectations.

- Request a Separate, Written Trade-In Offer: At the dealership, request a formal appraisal and a written trade-in offer before discussing the new car purchase price. This is the “Two-Box Method” of negotiation, ensuring the “Trade-In Value” is evaluated independently.

- Negotiate the Deduction Amount Using Your Quotes: Once the dealer provides their trade-in offer and deduction amount, use your independent repair estimates to challenge their figures. Focus on the “Negotiation Tactics” outlined below. Ask for a line-item deduction breakdown.

- Disclose All Known Mechanical Issues in Writing: To protect yourself legally, provide the dealership with a written list of all known mechanical defects, even when trading the vehicle “as-is.” This “Seller Disclosure” satisfies consumer protection laws and prevents future liability.

How Should You Use Independent Mechanic Quotes to Counter a Low Trade-In Offer?

To counter the deduction, anchor the conversation around your independent mechanic’s retail quote, then ask the dealer to clarify how their internal wholesale cost differs from the deduction, targeting the risk reserve component for reduction. This strategy leverages your “Mechanic Repair Estimate” as a powerful “Negotiation Anchor” against the “Dealer Deduction.” The dealer is negotiating the cost of goods sold, not the car’s profit.

Here’s how to engage in the negotiation:

- Present Your Anchor: Start by saying, “My independent mechanic quoted me $[X] for [specific repair]. I understand you have a wholesale advantage, but your deduction of $[Y] seems excessive given my quote.”

- Request a Breakdown: Politely but firmly ask the appraiser for a line-item breakdown of their “Wholesale Repair Cost” for each significant defect. This transparency is crucial.

- Challenge the Risk Reserve: Once they provide their wholesale cost, question any additional buffer they’ve added. “I see your wholesale cost for the transmission is $[A]. Why is there an additional $[B] deduction beyond that? Is that a risk reserve, and if so, can we adjust it?”

- Focus on the Net Difference: Remember that the dealer’s appraisal decision is primarily based on the estimated time and cost needed to make the car ‘front-line ready’ for retail sale. You want the net difference between your new car purchase price and your trade-in offer to be as low as possible. Never negotiate the deduction without a written, itemized quote in hand.

What Do You Need To Know About Negative Equity, Titles, And Legal Disclosure?

When trading in a damaged car, the repair deduction is subtracted from the wholesale value, potentially pushing the owner deeper into negative equity, which must then be settled by rolling it into the new vehicle loan. Furthermore, navigating title transfer and “Seller Disclosure” laws is paramount to avoid legal risks. These high-stakes financial and legal considerations are critical to a smooth transaction.

The presence of significant “Car Repair” needs directly impacts your “Equity Status.” If your vehicle already has “Negative Equity” (meaning your outstanding loan balance exceeds its current value), a large repair deduction will deepen that deficit. The dealership will handle the “Lienholder Loan Payoff” as a standard part of the transaction. However, any negative equity will either need to be paid out-of-pocket or, more commonly, rolled into the financing of your new vehicle, increasing your new loan amount and interest paid over time.

“Legal obligations selling broken car” are critical. Most states have “Disclosure Laws” requiring sellers, even to dealerships, to disclose known mechanical defects. To mitigate legal risk, the seller must provide the dealership with a written disclosure of all known mechanical defects, even when trading in a vehicle ‘as-is,’ to satisfy consumer protection laws. This written record protects you from potential contract rescission or future legal claims. Ensure your vehicle’s “Title Status” is clear and ready for transfer.

Mandatory Disclaimer: This content provides general information and does not constitute financial, legal, or automotive advice. Always consult a qualified financial advisor, legal professional, or certified mechanic for advice specific to your situation. State and local laws regarding vehicle sales and disclosure vary.

What Are The Consequences of Trading In a Car With Undisclosed Major Defects?

Attempting to conceal known major mechanical defects during a trade-in can lead to the dealer rescinding the contract, especially if the issue affects safety or was immediately apparent during a post-sale internal inspection. While dealer appraisals are rigorous, the legal obligation often remains with the seller for known defects.

Dealerships employ thorough mechanical inspections and rely on comprehensive “Vehicle History Reports” (VHRs) like CarFax during the transaction. It is highly probable they will discover known mechanical defects. If a major, known mechanical failure (e.g., a blown engine, transmission failure, or structural damage) is intentionally withheld and later discovered, the dealer may have legal recourse. This can lead to “Contract Rescission” (voiding the entire deal) and “Seller Liability” for damages.

Always disclose major known issues in writing to insulate yourself from legal claims. Transparency regarding known issues, backed by external repair quotes, actually builds trust and can lead to a slightly better, more realistic offer, rather than leading to a low-ball offer.

What Are The Alternatives To Trading In A Damaged Car?

Beyond a dealership trade-in, key alternatives for a damaged car include a private party sale, selling to online buyers like CarMax or Carvana, or even selling for scrap, each with varying financial returns, time investments, and hassle factors. Your choice depends on your priorities: maximizing “Net Financial Return” versus minimizing inconvenience.

| Option | Net Financial Outcome (Estimate) | Hassle Factor (1=Low, 5=High) | Time Required | Risk Profile |

|---|---|---|---|---|

| Trade In As-Is | Wholesale Value – Deduction + Tax Savings | 1 | Same Day | Low (High Deduction Risk) |

| Fix and Trade In | Wholesale Value – Cost of Repair + Tax Savings | 3 | 3-5 Days | Medium (Loss of ROI Risk) |

| Fix and Sell Private | Retail Value – Cost of Repair | 5 | 2-4 Weeks | High (Liability & Time Risk) |

| Sell for Scrap/Parts | Salvage Value (Minimal) | 2 | 1-2 Days | Low (Guaranteed Minimum Payout) |

Here’s a breakdown of the primary alternatives:

- Private Party Sale: This option generally offers the highest potential “Net Financial Return” for a damaged car. However, it comes with a “High Hassle Factor,” requiring you to advertise, show the car, manage negotiations, and potentially deal with buyers concerned about the repairs. “Private Party Car Sale” also carries a greater “Liability Risk,” especially with major defects.

- Online Buyers (CarMax/Carvana): These services provide quick, fixed-price offers for your damaged vehicle. They offer convenience and a guaranteed sale with a lower hassle factor than private sales. While their offers may not be as high as a successful private sale, they can provide a good “Online Car Valuation Tool” benchmark offer and a fast, streamlined process.

- Selling for Scrap/Parts: For non-running or severely damaged vehicles that are not economically repairable, selling to a “Scrap Yard” or for parts yields the lowest financial return (the “Salvage Value”). However, it offers the least hassle and virtually eliminates seller liability.

The highest potential net financial return for a damaged car is achieved through a private party sale, though this path entails the greatest risk and time investment, particularly if the needed repairs are major. Selling a non-running or severely damaged car to a scrap yard or for parts provides the lowest financial return but requires the least time and virtually eliminates seller liability.

How Does Selling a Damaged Car Privately Compare to a Dealer Trade-In?

A major advantage of a dealership trade-in is the potential tax savings, where the trade-in value reduces the amount subject to sales tax on the new vehicle, a benefit unavailable in a private sale. This “Tax Savings (Trade-In)” can significantly impact your overall “Net Financial Outcome.” The average tax savings on a $10,000 trade-in at a 7% state tax rate is $700, a factor that must be added to the trade-in offer.

Here’s a comparison:

- Dealer Trade-In Pros:

- ✅ Convenience: Instant sale, no advertising or dealing with buyers.

- ✅ Tax Savings: In many states, the trade-in value reduces the taxable amount of your new car purchase.

- ✅ Lower Risk: The dealer assumes liability for known defects once disclosed.

- ✅ Financing Simplicity: Especially helpful if you have negative equity; the dealer can roll it into the new loan.

- Dealer Trade-In Cons:

- ❌ Lower Financial Return: The trade-in value is typically 15-20% lower than a private sale, and even more so with repair deductions.

- ❌ Less Negotiation Room: Especially for heavily damaged cars, the dealer’s offer is constrained by wholesale market values.

- Private Party Sale Pros:

- ✅ Potentially Higher Financial Return: You can often fetch a higher price than a dealership trade-in.

- ✅ Control: You set the price and terms of sale.

- Private Party Sale Cons:

- ❌ High Hassle Factor: Requires time for advertising, showing the car, and handling paperwork.

- ❌ Increased Liability: “As-is” sales protection is weaker in private transactions, increasing “Seller Liability” for undisclosed issues.

- ❌ No Tax Savings: The sale doesn’t contribute to tax savings on a new purchase.

The decision between a “Private Party Sale” and a “Dealership” trade-in for a damaged car hinges on balancing potential profit against the significant hassle and increased liability.

FAQs About can you trade in a car that needs repairs

Can I trade in a car that has a blown engine or transmission failure?

Yes, you can trade in a car with a blown engine or transmission, but expect the trade-in value to be severely impacted, often reduced to near wholesale or salvage price. Dealerships typically send vehicles with such major powertrain failures directly to auction or use them for parts, as the required reconditioning costs are too high for immediate retail sale. This significantly limits your negotiation leverage.

Should I fix minor cosmetic damage like scratches or dents before trading in?

Yes, fixing minor cosmetic damage, such as small dents or deep cleaning the interior, often provides a high return on investment (ROI) before trading in. Since these repairs are generally inexpensive (under $500), they improve the appraiser’s subjective assessment of the car’s overall care and condition, helping move the car out of the ‘Poor’ valuation category.

Will the dealer find out about the car’s problems if I don’t tell them?

Yes, dealerships employ thorough mechanical inspections and rely on comprehensive Vehicle History Reports (VHRs) like CarFax, making it highly probable they will discover known mechanical defects. Failing to disclose known issues can damage trust, reduce your negotiation leverage, and, in some cases involving safety defects, lead to contract rescission based on fraud.

How much do dealers typically deduct for a major repair like a transmission replacement?

Dealers typically deduct the estimated wholesale repair cost plus a risk reserve, which averages 50-70% of what the repair would cost you at a retail mechanic. For a transmission replacement that costs a consumer $4,000, the dealer might deduct $2,500 to $3,000 because they utilize lower internal labor rates and wholesale parts pricing.

Can I trade in a car if I still owe money on the loan (negative equity)?

Yes, you can trade in a car with an outstanding loan balance; the dealership will handle the lien payoff as part of the transaction. If the required repair deduction results in negative equity (the loan balance exceeds the trade-in value), that financial deficit will typically be rolled into the financing of your new vehicle purchase.

Is it necessary to get a mechanic’s repair estimate before going to the dealership?

Yes, obtaining at least one independent, itemized mechanic’s quote beforehand is critical, as it provides you with a financial anchor point for negotiation. This quote allows you to challenge the dealer’s trade-in deduction by requiring them to justify their wholesale reconditioning costs against your documented retail cost baseline.

What documents are required to trade in a damaged car?

You need the vehicle title (or lienholder payoff information), current vehicle registration, a valid driver’s license, all sets of keys, and importantly, documentation (in writing) of any major mechanical defects you are disclosing to the dealer.

How long does the appraisal process take for a car with significant mechanical issues?

Due to the need for a thorough mechanical check, an appraisal for a car with problems often takes longer, usually 1 to 2 hours, compared to the 30 minutes typically required for a clean vehicle. The appraiser must carefully assess drivability, safety systems, and the severity of mechanical failures.

Key Takeaways: Trading In A Car With Repairs Summary

- Avoid Major Repairs: Never pay retail price for a major repair (exceeding $1,500 and involving powertrain or structure) before trading in, as the dealership’s wholesale cost advantage negates your financial return on investment.

- Prioritize Minor Fixes: Focus your pre-appraisal budget on low-cost, high-impact maintenance like deep cleaning, fixing small cosmetic issues, or addressing minor dashboard warning lights, as these significantly improve the appraiser’s subjective valuation.

- Understand Dealer Math: Recognize that the dealer’s deduction is based on their internal wholesale repair cost plus a risk reserve, which is typically 50-70% of what your mechanic quotes; use this differential as your negotiation anchor.

- Negotiate the Deduction Separately: Secure multiple independent mechanic estimates prior to the appraisal, and use them to challenge the dealer’s specific repair deduction amount rather than just focusing on the final trade-in number.

- Handle Negative Equity Strategically: If your remaining loan balance combined with the repair deduction results in negative equity, ensure you understand the long-term cost implications of rolling that deficit into your new vehicle loan.

- Document All Disclosures: Protect yourself legally by providing the dealer with a written list of all known mechanical defects, maintaining transparency and reducing your liability risk associated with state consumer protection laws.

- Compare All Four Paths: Always use a decision framework to compare trading in as-is against fixing-and-selling (privately or trading) and selling for scrap, ensuring you factor in the valuable trade-in tax credit benefit.

Final Thoughts on Trading In a Car That Needs Repairs

The decision to trade in a car that needs repairs is fundamentally a financial calculation, not a matter of feasibility. By understanding the “Dealer Math”—the difference between retail and wholesale reconditioning costs—you shift the power dynamics from passive acceptance to active negotiation. The ultimate strategy is to avoid investing your high-cost retail dollars into repairs that the dealer will only value at their lower wholesale rate. Focus instead on full transparency, utilizing independent quotes as a non-negotiable anchor, and always ensuring you negotiate the new car price and the trade-in deduction as entirely separate items. Use the comprehensive framework provided to minimize your financial loss and navigate the complex process with confidence.

Last update on 2026-01-26 / Affiliate links / Images from Amazon Product Advertising API