Navigating the administrative tasks after a loved one’s passing can be a challenging and emotional journey. When one of those tasks is figuring out how to transfer car title after death, the process can seem confusing, filled with unfamiliar forms and legal terms that add stress to an already difficult time. You might be wondering if probate is required, what paperwork you need, and where to even begin.

To transfer a car title after the owner has passed away, you must first determine if the estate is being probated and how the car was owned (solely or jointly). Then, you’ll gather universal documents like the death certificate and original title, plus specific forms like Letters Testamentary (for probate) or an Affidavit of Heirship (for non-probate), and submit everything to your local DMV.

This comprehensive guide, built on a thorough analysis of state requirements and established procedures, will provide a clear, step-by-step roadmap. We will break down the process into simple, actionable stages, ensuring you understand exactly what to do based on your specific situation. From identifying the correct legal path to submitting the final paperwork, you’ll find the clear, data-driven answers you need to navigate this process with confidence.

Key Facts

- Ownership Is Key: How the title is worded—solely owned, jointly with “or,” or jointly with “and”—is one of the most significant factors determining the complexity and path of the transfer process.

- Probate Dictates the Path: Whether the deceased’s estate is subject to a formal court probate process is the primary deciding factor for which legal documents you will need; a probated estate requires court-issued “Letters Testamentary.”

- The Death Certificate is Non-Negotiable: A certified copy of the death certificate is a universal requirement for any title transfer involving a deceased owner, serving as the foundational legal proof.

- State Laws Vary Significantly: The exact forms and procedures differ widely from state to state. For example, California may require a REG 5 form for non-probate transfers, while Florida uses forms like the HSMV 82040.

- An Outstanding Loan Must Be Addressed: Any existing loan on the vehicle does not disappear upon the owner’s death; the debt must be settled by the estate or the inheriting beneficiary before a clear title can be issued.

The First Step: Determine the Car’s Ownership and Estate Status

Before visiting the DMV, you must first identify the correct legal path by confirming if the estate is in probate and how the deceased’s name appears on the title (sole owner or joint owner). This initial diagnostic step is the most critical part of the entire process, as it dictates all subsequent paperwork and procedures, preventing errors and wasted time. Before gathering any paperwork, can you answer these two questions about the estate and the title?

Understanding your specific situation begins with defining a few key terms in simple language:

* Probate: This is the formal legal process where a court oversees the distribution of a deceased person’s assets and the settling of their debts.

* Executor/Administrator: This is the person legally appointed by the probate court to manage the deceased’s estate.

* Intestate: This term describes the situation when a person dies without a valid will. State laws, known as intestacy laws, then determine who inherits the property.

Your path forward will fall into one of these primary scenarios:

- Sole Ownership: The vehicle title is in the deceased’s name only. The car is considered part of the estate and its transfer is subject to probate rules or non-probate affidavits.

- Joint Ownership with “OR”: The title lists the deceased AND/OR another person (often a spouse). In most states, this simplifies the process immensely. The surviving owner typically becomes the sole owner automatically.

- Joint Ownership with “AND”: The title lists the deceased AND another person. This is more complex, as both the surviving owner and a legal representative of the deceased’s estate must typically sign off on the transfer.

- Estate is in Probate: If the total value of the deceased’s assets requires it, the estate will go through probate. You cannot transfer the car title until the court grants the Executor permission to do so.

- Estate is NOT in Probate: For smaller estates or those with specific estate planning (like a trust), probate may not be necessary. The transfer is then handled by the next of kin using state-specific affidavit forms.

| Estate Status | What it Means for the Car Title Transfer | Key Document |

|---|---|---|

| Probate | The transfer is managed by a court-appointed Executor or Administrator. This process takes longer as you must wait for court approval. | Letters Testamentary or Letters of Administration |

| No Probate | The transfer is managed directly by the legal heirs or next of kin. This is typically a faster process handled directly with the DMV. | Affidavit for Transfer without Probate / Affidavit of Heirship |

Step 1: Gather the Universal Documents Required for Any Transfer

Collect these essential items first: the original vehicle title, a certified copy of the death certificate, your valid photo ID, and funds for the transfer fee. If the title is lost, contact the DMV with the death certificate to request a duplicate. No matter your specific situation regarding probate or ownership, a core set of documents will always be required to initiate the process of learning how to transfer car title after death.

Pro Tip: Place all these core documents in a single folder now. This simple organization will save you time and stress at the DMV.

Here is the essential checklist of what you’ll need to gather:

- The Original Car Title: This is the single most important document. It proves legal ownership.

- Certified Copy of the Death Certificate: This is the official legal proof of the owner’s passing. Photocopies are generally not accepted; you will need an official, certified copy from the vital records office.

- Proof of Identity for the New Owner: The person inheriting the vehicle will need to present their valid driver’s license or other government-issued photo ID.

- Odometer Disclosure Statement: For most vehicles, federal law requires the mileage to be recorded at the time of transfer. This is often a section on the back of the title itself, but some states may have a separate form.

- Payment for the Transfer Fee: Every state charges a fee to issue a new title. Check your local DMV’s website for the exact amount and accepted payment methods.

- Proof of Insurance: If the new owner plans to register and drive the vehicle, they will need to show proof of active car insurance.

What If the Original Title is Lost?

Do not panic. The executor of the estate or the legal next of kin can typically apply for a duplicate title. You will need to contact your state’s motor vehicle authority and will almost certainly need to provide the certified death certificate and proof of your legal standing to make the request on behalf of the deceased.

Step 2: Secure Specific Paperwork Based on the Estate’s Status

Your next step depends on the estate: for a probated estate, obtain court-issued “Letters Testamentary”; for non-probated estates, you will likely need a state-specific “Affidavit for Transfer without Probate” signed by the heirs. Once you have the universal documents, you must acquire the specific legal paperwork that authorizes the transfer based on the estate’s legal status. This is where the path diverges, and getting the right form is crucial.

If the Estate is in Probate

For an estate being managed through the probate court system, the transfer of any assets, including a vehicle, is handled with strict legal oversight. The title cannot be transferred until the court officially grants permission. The court-appointed Executor or Administrator is the only person with the legal authority to act on behalf of the estate.

Pro Tip: The Executor or Administrator is the only person who can sign on behalf of the deceased for a probated estate. Do not sign it yourself.

You will need the following documents from the court:

* Letters Testamentary or Letters of Administration: This is the official court document that legally proves who the Executor or Administrator is and gives them the authority to manage the estate’s assets.

* Order from the Probate Court: In many cases, a specific order from the court will be required that explicitly allows for the transfer or sale of the vehicle.

* Bill of Sale: If the vehicle is being sold by the estate to a third party rather than being transferred to an heir, a formal Bill of Sale will be required.

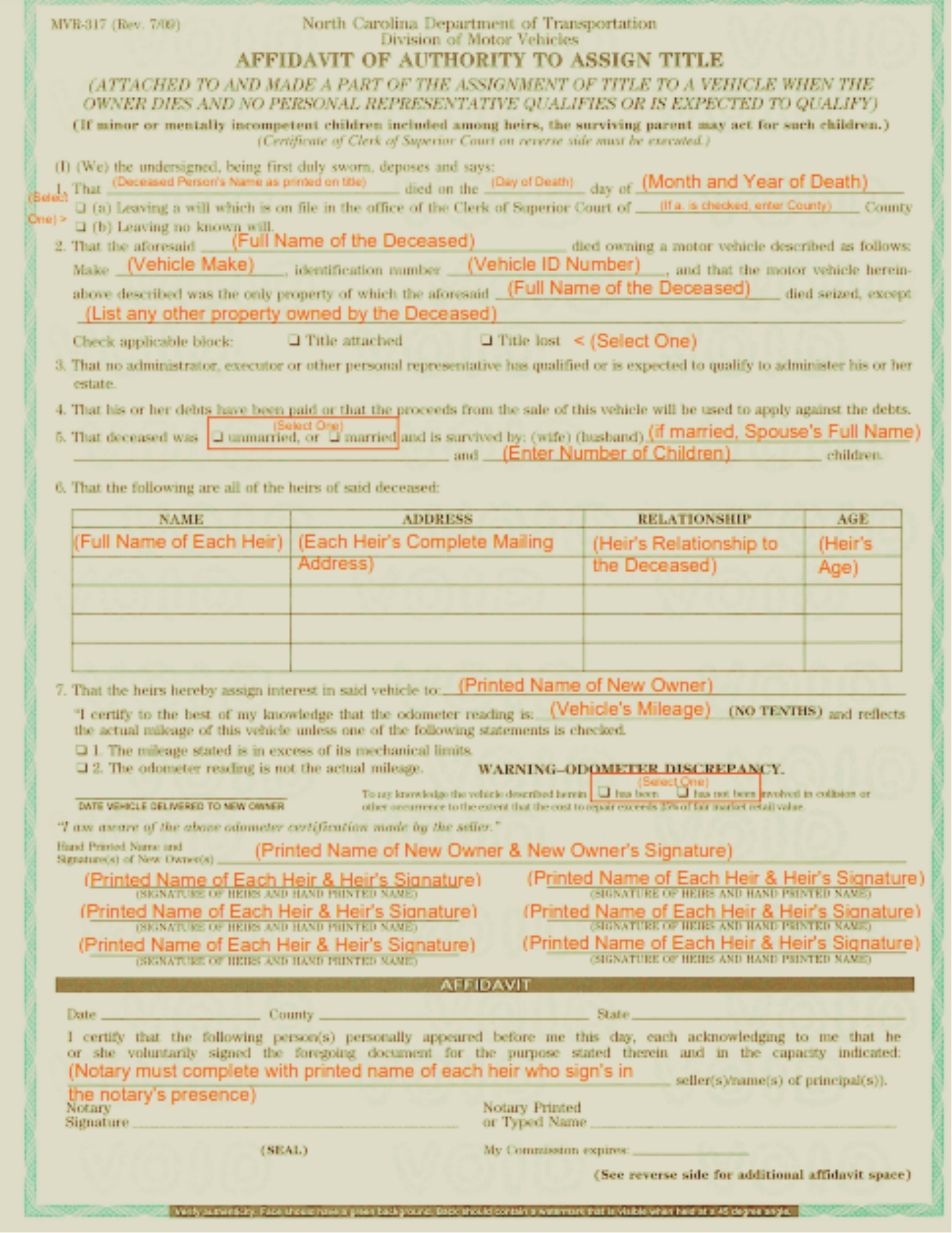

If the Estate is NOT Probated (With or Without a Will)

This is a more common scenario for many families, especially when the overall value of the estate falls below the state’s threshold for mandatory probate. In this case, the legal heir(s) or next of kin handle the transfer directly with the DMV using a sworn legal statement known as an affidavit. An “affidavit” is simply a written statement confirmed by oath, used as evidence in court or before a government agency.

Important: Many states have a value limit for vehicles that can be transferred this way. Check your state’s DMV website for this threshold.

The key documents for a non-probated transfer are:

* Affidavit for Transfer without Probate / Affidavit of Heirship: This is the central document. By signing it, the heir(s) swear that there is no probate proceeding, the estate is not indebted (or debts have been handled), and they are the rightful inheritor(s) according to the will or state law.

* A Certified Copy of the Will: If the deceased left a will, you will need to present it along with the affidavit.

* Application for Certificate of Title: The new owner must fill out the standard application form to have a new title issued in their name.

Demonstrating specific expertise, several states have unique forms for this process. For instance, data shows that California requires an Affidavit for Transfer without Probate (REG 5) for inheritance transfers. Likewise, Florida uses specific forms like the HSMV 82040, and Texas residents may use Form 130-U, the “Application for Texas Title and/or Registration.”

Step 3: Complete the Transfer at Your Local Motor Vehicle Office

Take all completed forms, the original title, the death certificate, and your ID to the DMV. You will submit the paperwork, sign the title application, and pay the transfer fee to receive a new title in your name. With all your universal and situation-specific documents organized, you are ready for the final step: visiting your local DMV, Motor Vehicle Authority, or county title office to make the transfer official.

Pro Tip: Call your local DMV office beforehand or check their website to confirm their exact requirements, office hours, and accepted payment methods to avoid a second trip.

Here is your game plan for the visit:

1. Submit Your Document Packet: Present the clerk with your complete set of documents: the original title, certified death certificate, your photo ID, and the appropriate legal authorization (Letters Testamentary or the completed Affidavit).

2. Sign the Title and Application: The back of the original title will need to be signed. If you are the Executor, you will sign on behalf of the estate. If you are the heir, you will sign as the new owner (“buyer”). You will also sign the new Application for Certificate of Title.

3. Pay All Required Fees: Be prepared to pay the title transfer fee and any other applicable state or local taxes. In some cases, sales tax may be due, though many states provide exemptions for inherited vehicles.

Once all the paperwork is accepted and fees are paid, the state will process the transaction and mail a new, official car title to the new owner, completing the legal transfer of ownership.

Special Considerations: Car Loans, Selling the Vehicle, and State Variations

Remember to address any outstanding car loans, as the debt does not disappear. You must transfer the title to your name before you can sell the car, and always verify the exact procedure with your state’s DMV as rules can differ significantly. The core process covers most situations, but several common “what if” scenarios can arise when you how to transfer car title after death. Addressing these potential complexities early can prevent major headaches later.

What if the Car Has an Outstanding Loan?

A key takeaway: an inherited car can sometimes mean an inherited debt. Always check for an outstanding loan with the lender early in the process. If a loan exists, the lienholder (the bank or finance company) must be paid off before a clear title can be issued to a new owner. The estate is typically responsible for paying the debt. If the estate cannot cover the loan, the lender may have the right to repossess the vehicle.

Can I Sell an Inherited Vehicle?

Yes, but you must follow the proper legal sequence. You cannot sell a vehicle that is not legally in your name. Therefore, you must first complete the entire title transfer process detailed above to have a new title issued in your name as the legal owner. Once you are the titled owner, you are free to sell the vehicle. If the car was inherited by multiple beneficiaries, all parties must agree on the sale.

The Critical Importance of State Variations

While this guide provides a general framework, it is absolutely essential to recognize that motor vehicle laws are determined at the state level. The exact forms, fees, and procedures can and do vary. As previously mentioned, specific procedures in states like California, Florida, Texas, and Iowa highlight this diversity. Your state’s DMV website is the ultimate authority. Always use this guide as your roadmap, but confirm every detail with your local office before you go.

To keep all your essential documents—like the death certificate, original title, and DMV forms—organized and protected during your visit, consider using a durable document portfolio or expanding file folder.

FAQs About Transferring a Car Title After Death

How do I transfer a car title if I am the surviving spouse?

If the title lists you and your deceased spouse with “or” between the names, the process is usually simple. You can typically take the original title and the death certificate to the DMV to have a new title issued in your name alone. If the title uses “and,” the process is more complex and follows the standard procedures for transferring from an estate.

Can I transfer the car title of a deceased person online?

In most cases, no. Due to the sensitive nature of the transaction and the need to verify original documents like a certified death certificate and the original title, the how to transfer car title after death process almost always requires an in-person visit to a DMV or county title office.

What happens if the car was jointly owned with “and” between the names?

When “and” connects the names on a title, both parties have equal ownership rights. This means the surviving owner does not automatically inherit the vehicle. To transfer the title, you will need the signature of the surviving owner AND the signature of the legally appointed representative (Executor or Administrator) of the deceased’s estate.

How long do I have to transfer the title after the owner’s death?

There is generally no strict, universal deadline, but it is highly advisable to complete the transfer as soon as possible. Waiting can complicate matters related to insurance, registration renewal, and the settling of the estate. Some states may have specific timeframes, so it is best to act promptly once you have the necessary documentation.

Do I have to pay sales tax on an inherited vehicle?

This depends entirely on your state’s laws. Many states provide a sales tax exemption for vehicles transferred to a direct heir, spouse, or next of kin as part of an inheritance. However, some states may still charge tax based on the vehicle’s value. Always check with your local DMV to confirm the tax implications.

Final Summary: Key Steps for a Smooth Title Transfer

Navigating the transfer of a car title after a death requires careful attention to detail, but it can be managed by following a logical sequence. The process is fundamentally about proving legal authority to act on behalf of the deceased and providing the correct documentation to your state’s motor vehicle department. By understanding the path ahead, you can reduce stress and complete the task efficiently.

To successfully how to transfer car title after death, remember these core phases:

* 1. Identify Your Path: First, determine if the estate is in probate and check the original title to see if it was solely or jointly owned. This crucial first step dictates all of your subsequent actions.

* 2. Gather All Paperwork: Collect the universal documents needed in every case (title, death certificate, ID) and then secure the specific legal forms for your situation (Letters Testamentary for probate or a state-specific Affidavit for non-probate).

* 3. Finalize at the DMV: With all your documents in order, visit your local motor vehicle office to submit the paperwork, sign the necessary forms, pay the fees, and have a new title issued in the new owner’s name.

You now have a clear roadmap. Take a deep breath, follow these steps, and always verify specific forms and rules with your local DMV. You can navigate this process successfully.

Last update on 2025-12-02 / Affiliate links / Images from Amazon Product Advertising API