That sinking feeling after an accident is often followed by a wave of uncertainty, especially about the fate of your vehicle. You’re left wondering, “Is it just a bad dent, or is my car a total loss?” This guide is designed to replace that anxiety with clarity, breaking down exactly how to know if your car is totaled.

A car is declared “totaled” when the estimated cost to repair its damage is higher than its Actual Cash Value (ACV) right before the accident. Insurers may also declare it a total loss if it’s deemed unsafe to drive even after comprehensive repairs.

Leveraging extensive analysis of claim processes and insurance guidelines, this guide unpacks the official criteria and visual cues that signal a total loss. We’ll walk you through the entire process, from the initial on-scene assessment to understanding the insurance adjuster’s calculations and successfully navigating your settlement, giving you the critical insights needed to handle this stressful situation with confidence.

Key Facts

- The Core Formula: A car is primarily considered totaled when the cost of repairs exceeds its Actual Cash Value (ACV), which is its market worth right before the accident.

- State Laws Dictate the Threshold: Each state sets a specific “total loss threshold,” a percentage of the car’s value that repair costs must exceed. This can range from as low as 60% in Oklahoma to 100% in Colorado, with many states like Alabama using a 75% rule.

- Airbag Deployment Isn’t an Automatic “Total”: While replacing deployed airbags is expensive and significantly increases the repair estimate, it does not, by itself, automatically mean a car is totaled. It is just one major factor in the overall cost calculation.

- You Can Negotiate the Payout: The insurance company’s initial settlement offer is not always the final word. As a policyholder, you have the right to dispute their valuation by providing evidence like independent appraisals and listings for comparable vehicles.

- Keeping Your Car is an Option: In many cases, you can choose to keep your totaled car. If you do, the insurance company will deduct the vehicle’s salvage value from your final settlement check, and the car will be issued a “salvage title.”

What Does “Totaled Car” Actually Mean for You?

A car is declared “totaled” when the estimated cost to repair its damage is higher than its Actual Cash Value (ACV) right before the accident, or if it’s deemed unsafe to drive even after repairs. This is the official definition insurance companies use to decide whether to pay for repairs or to write you a check for your car’s value.

But what does it really mean when they say the repair cost is more than the car is worth? Let’s break it down. It’s not just about a few dents and scratches; it’s a financial and safety calculation. An insurer determines that it makes more sense to pay you the value of the car and sell the damaged vehicle for salvage parts than it does to invest in extensive and costly repairs.

Here are the core concepts that go into this decision:

- Repair Cost vs. Actual Cash Value (ACV): This is the main event. An insurance adjuster will create a detailed estimate of all repair costs. They then calculate your car’s ACV—what it was worth on the open market one minute before the crash. If the repair bill is bigger than the ACV, it’s typically a total loss.

- State Thresholds: Your location matters. States have laws that set a “total loss threshold,” which is a percentage. For example, if your state’s threshold is 75% and your car is worth $10,000, it will be declared totaled if repairs are estimated to cost $7,500 or more.

- Safety Concerns: Sometimes, a car can be totaled even if the repair costs are below the ACV. This happens if the damage is so severe (like a bent frame) that the vehicle would be structurally unsafe to drive, even after being fixed.

5 Key Signs Your Car Might Be Totaled After an Accident

Look for major signs like a severely bent frame, significant fluid leaks (oil or coolant), extensive front-end damage, and deployed airbags, as these often lead to repair costs that exceed the vehicle’s value. While only a professional adjuster can make the final call, these visual cues can give you a strong indication of what to expect.

Pro Tip: While you can look for these signs, always wait for a professional assessment. Hidden damage is common and can drastically change the repair estimate.

Here are five key signs that can help you understand how to know if your car is totaled:

- Significant Frame Damage: The frame is your car’s skeleton. If you notice doors that don’t open or close properly, uneven gaps between body panels, or if the car visibly leans or twists, the frame is likely bent. Frame damage is incredibly expensive and complex to repair correctly, making it a primary reason for a total loss declaration.

- Major Fluid Leaks: Puddles of liquid under your car after a crash are a bad sign. Dark brown or black fluid is likely oil, while bright green, pink, or orange fluid is coolant. Significant leaks suggest damage to critical components like the engine block, radiator, or transmission, which are all high-cost repairs.

- Severe Front-End or Rear-End Damage: If the front of your car is pushed in to the point where the engine is impacted, or the rear is crushed into the trunk space, the repair costs will skyrocket. These impacts often damage not only the body panels but also the engine, drivetrain, suspension, and other critical mechanical parts.

- Deployed Airbags: This is a crucial indicator. While airbag deployment does not automatically mean your car is totaled, it is a very expensive repair. Replacing the airbags themselves, the sensors, and often the dashboard or steering column can add thousands of dollars to the repair bill, pushing many vehicles over the total loss threshold.

- Extensive Dents and Scratches Across the Vehicle: Widespread damage, especially if it includes the roof, undercarriage, and multiple body panels, can quickly add up. A vehicle that has rolled over or been hit from multiple angles often has so much cosmetic and structural damage that fixing it is more expensive than its value.

:max_bytes(150000):strip_icc()/is-my-car-totaled-527100-Final-5c4751d246e0fb0001b417d2.png)

https://m.youtube.com/watch?v=krgdoXBttBI&t=29s

How Insurance Companies Calculate a Total Loss: The Official Process

Insurers determine a total loss by sending an adjuster to estimate repair costs, calculating the car’s Actual Cash Value (ACV) before the accident, and then checking if the repair cost exceeds a specific percentage threshold (e.g., 75%) set by the state or the insurer. It’s a methodical process designed to be objective and based on clear financial data.

Think of the state threshold as a pass/fail line. If the repair cost percentage crosses that line, the car is officially a total loss. Understanding this process removes the mystery and helps you see exactly how to know if your car is totaled from the insurer’s perspective.

Here are the three main steps in the official process:

- Damage Inspection and Repair Estimate: After you file a claim, the insurance company dispatches an adjuster. Their job is to perform a thorough inspection of your vehicle to document every bit of damage. They then use standardized software to generate a detailed estimate of what it would cost to restore the car to its pre-accident condition.

- Actual Cash Value (ACV) Calculation: Simultaneously, the insurer calculates your car’s ACV. This isn’t what you paid for it; it’s what your car was worth in the local market right before the accident happened. They use third-party data services to analyze your car’s make, model, year, mileage, features, and overall condition.

- Threshold Comparison: With the two key numbers—the repair estimate and the ACV—the insurer does the final check. They compare the repair cost against the ACV, using the total loss threshold set by your state’s law.

To show how much this can vary, here are a few examples of state-mandated total loss thresholds:

| State | Total Loss Threshold (% of ACV) |

|---|---|

| Alabama | 75% or greater |

| Oklahoma | 60% or greater |

| Colorado | 100% |

Understanding Your Car’s Actual Cash Value (ACV)

ACV is your car’s market value right before the crash, determined by its make, model, year, mileage, overall condition, and sales of similar vehicles in your area. This number is the single most important factor in a total loss claim because it determines the amount of the settlement check you will receive.

Insurance companies don’t just guess this number. They work with specialized third-party vendors that aggregate massive amounts of vehicle data. These vendors, which may use information similar to Kelley Blue Book (KBB), track what every make and model sells for as it ages to determine its fair market value.

The factors that influence your car’s ACV include:

- Make, Model, and Year: The foundation of its value.

- Mileage: Lower mileage generally means a higher value.

- Overall Condition: This includes the state of the interior, exterior paint, and tires before the accident.

- Recent Upgrades: New tires or a recent major service can sometimes increase the value.

- Local Market Demand: The value is based on what similar cars are selling for in your specific geographic area.

A common point of confusion is the difference between ACV and replacement cost. ACV is what your car was worth, which is affected by depreciation. It is almost always less than what you would need to buy a brand-new version of the same car.

The Role of State Thresholds and the Total Loss Formula

States set a Total Loss Threshold, a percentage of the car’s value (e.g., 75%). If repair costs exceed this, it’s totaled. Some states use a formula: if repairs cost more than the car’s value minus its salvage value, it’s also totaled. These two models are the legal and financial frameworks that guide an insurer’s decision.

Quick Fact: An insurer might total a car even if it’s below the official threshold because they anticipate finding more damage once repairs start. It can be more cost-effective to declare it a loss upfront than to approve a supplemental repair bill later.

The Total Loss Threshold (TLT) is the most common method. As shown in the table above, it’s a straightforward percentage. If a car’s ACV is $20,000 and the state threshold is 75%, it will be totaled if repair estimates exceed $15,000. It’s important to know that while states set this legal benchmark, an insurer is often free to use their own, lower threshold if it’s part of their policy.

The second method is the Total Loss Formula (TLF), used in states without a specific percentage threshold.

The Total Loss Formula:

(Fair Market Value) – (Salvage Value) = Total Loss Point

If the estimated repair costs are greater than this resulting number, the vehicle is declared a total loss.

Salvage value is the amount the insurance company can get by selling your wrecked car to a salvage or junk yard. For example, if your car’s ACV is $15,000 and its salvage value is $4,000, the total loss point is $11,000. If repairs are estimated at $11,500, the car is totaled.

What Happens Next: Navigating the Total Loss Claim

After a total loss declaration, you’ll receive a settlement offer based on the car’s ACV. You can negotiate this offer, and once accepted, you’ll transfer the car’s title to the insurance company unless you choose to keep the car for a reduced payout. This next phase is all about managing the settlement and making key decisions.

The insurance company gave you their offer. But is that the final word? Not always. This is where your understanding of the process becomes a powerful tool. Knowing your rights and options is crucial to ensuring you receive a fair settlement and can move forward.

Here is the typical process flow after the declaration:

- Receive Official Notification: The insurance adjuster will formally contact you to inform you that your vehicle is a total loss. They will explain the basis for their decision, providing the repair estimate and their calculated ACV.

- Get the Settlement Offer: The insurer will present you with a settlement offer. This amount is based on the ACV, minus any deductible on your policy.

- Review and Negotiate if Needed: Carefully review the valuation report the insurer provides. If you believe the ACV is too low, you have the right to negotiate. This is the time to present your own research and evidence to support a higher value.

- Decide on the Car’s Fate: You have two main choices. Most people accept the settlement, sign over the title, and let the insurance company take the car. Alternatively, you can choose to keep the car, in which case the insurer will pay you the ACV minus both your deductible and the car’s salvage value.

How to Negotiate a Higher Settlement for Your Totaled Car

To negotiate a higher payout, provide your insurer with evidence like independent appraisals, listings for comparable cars for sale in your area, and records of recent maintenance or upgrades. Don’t simply accept the first offer if you feel it’s unfair. As the policyholder, you have the right to dispute the valuation, but you must back it up with solid documentation.

Gathering your evidence is the key to a successful negotiation. Here is the kind of documentation that can strengthen your case for a higher ACV:

- Listings for Comparable Vehicles: Find several listings for cars of the same make, model, year, and similar mileage that are for sale in your local area. This is powerful evidence of the true local market value.

- An Independent Appraisal: You can hire a certified appraiser to conduct their own valuation of your vehicle. While this comes at a cost, a professional report can carry significant weight with the insurance company.

- Maintenance and Upgrade Records: If you recently invested in the car, provide the receipts. This includes new tires, a new transmission, engine work, or any other significant upgrades that added value right before the accident.

- Pre-Accident Photos: If you have recent photos showing the excellent condition of your car before the crash, these can help counter a low valuation based on a generic condition report.

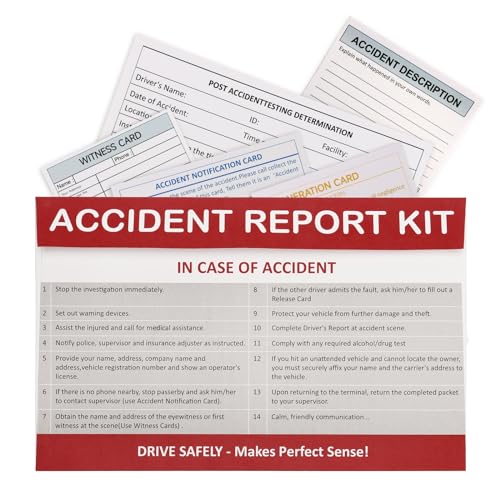

To make the process of documenting an accident easier and ensure you’re prepared for your next vehicle, having a dedicated kit in your car can provide peace of mind.

FAQs About a Totaled Car

What happens if my car is totaled but still drivable?

Even if a car seems drivable, it can be declared a total loss. The decision is based on the financial calculation (repair cost vs. value), not just its ability to move. Hidden structural or frame damage can make a drivable car unsafe, and the high cost of fixing these issues is often what leads to the “totaled” status.

What should I do if my car is totaled and I still owe money on the loan?

When your car is totaled, the insurance company sends the settlement check directly to your lender (the lienholder) first. The lender applies that payment to your outstanding loan balance. If the settlement is less than what you owe, you are responsible for paying the difference. This is where GAP (Guaranteed Asset Protection) insurance is crucial, as it is designed to cover this “gap.”

Who gets the insurance check when a car is totaled?

The check first goes to any lienholder on the vehicle’s title. If you have a car loan, your bank or credit union gets paid first. If the settlement amount is more than your remaining loan balance, you will receive a check for the difference. If you own the car outright with no loan, the full settlement check (minus your deductible) comes directly to you.

Can I keep my car if it’s declared a total loss?

Yes, in most states, you have the option to “owner-retain” your totaled vehicle. If you choose this, the insurance company will pay you the car’s actual cash value minus your deductible and the vehicle’s salvage value. The car will then be issued a salvage title, which can make it more difficult and expensive to insure and can lower its future resale value significantly.

Does airbag deployment automatically mean my car is totaled?

No, airbag deployment does not automatically total a car. However, it is a very expensive repair, often costing several thousand dollars to replace the airbags, sensors, and any damaged interior components like the dashboard. This high cost is a major factor that significantly increases the total repair estimate, making it much more likely that the vehicle will be declared a total loss.

Final Summary: Key Takeaways on a Totaled Car

Navigating a total loss claim can be stressful, but by understanding the process, you can approach it with confidence. The journey from the crash scene to the final settlement is a clear, data-driven procedure. Knowing how to know if your car is totaled is about recognizing the visual signs of severe damage and, more importantly, understanding the financial formula your insurance company uses. It’s a matter of repair costs versus your car’s value, all governed by your state’s specific laws.

Remember these critical points to ensure you get a fair outcome:

- It’s All About the Numbers: The core of a total loss decision is simple math: if Repair Costs > Actual Cash Value (or a state-mandated percentage of it), the car is totaled.

- ACV is King: Your car’s Actual Cash Value is the most important figure in the process. Do your own research on what similar cars are selling for in your area to ensure the insurer’s offer is fair.

- You Have Rights: Don’t be a passive participant. You have the right to question the insurer’s valuation and negotiate for a higher settlement by providing your own evidence.

- Know Your Options: Whether you take the full settlement and let the car go or choose to keep it for a reduced payout, you are in control of the final decision.

Take these insights, stay organized, and advocate for yourself. By being informed, you can turn a difficult situation into a manageable process and get back on the road.

Last update on 2025-08-20 / Affiliate links / Images from Amazon Product Advertising API

![Car Wrap vs. Paint: Cost Guide [year] 16 Car Wrap vs. Paint: Cost Guide [year]](https://carxplorer.com/wp-content/uploads/2025/08/is-it-cheaper-to-paint-or-wrap-a-car-2-60x60.jpg)

![Are Fords Good Cars? The Unbiased Truth for [year] 18 Are Fords Good Cars? The Unbiased Truth for [year]](https://carxplorer.com/wp-content/uploads/2025/08/is-ford-a-good-car-2-60x60.jpg)