That sudden, violent bang. The sharp smell of chemicals filling the cabin. The sight of a white bag deflating where your steering wheel used to be. After a car accident, the deployment of your airbags is a jarring event that immediately raises a critical question: is my car totaled if airbags deploy? You’re likely feeling shaken, stressed, and uncertain about what this means for your vehicle and your finances.

No, the deployment of airbags alone does not automatically mean your car is a total loss. The final decision is a purely financial one made by your insurance company, based on a comparison between the total cost of repairs and your car’s pre-accident Actual Cash Value (ACV).

This guide will demystify the entire process, moving beyond the common myths to show you exactly how insurers make the call. Leveraging extensive analysis of industry data and established assessment patterns, we will unpack the precise financial formulas, the true cost of airbag replacement, and the critical steps you need to take right now. You’ll learn what to look for, how to understand the numbers, and how to navigate your claim with confidence.

Key Facts

- Not an Automatic Total Loss: The single most important fact is that airbag deployment does not automatically total a car. It is a significant factor, but not the only one.

- It’s a Financial Calculation: A vehicle is declared a total loss when the cost to repair it exceeds a certain percentage of its Actual Cash Value (ACV), a threshold that varies by state and insurer.

- The 70-80% Rule: While it can vary, the total loss threshold is typically between 70% and 80% of the car’s ACV. Some states use a specific Total Loss Formula instead.

- High Cost of Replacement: A primary reason this is a major issue is the expense. Evidence suggests a single airbag replacement can cost between $1,000 and $1,500, including parts and labor.

- Indicator of Severe Impact: For insurance adjusters, deployed airbags are a red flag indicating a severe collision, prompting them to look for expensive, hidden structural damage.

Airbags Deployed? Here’s Why Your Car Isn’t Automatically Totaled

No, the deployment of airbags alone does not automatically mean your car is totaled. This is one of the most persistent myths in the automotive world. While airbag deployment is a clear sign of a significant accident, the decision to label a car a “total loss” is a matter of dollars and cents, not a single mechanical event.

The core takeaway is this: An insurance company totals a car when it is no longer economically viable to repair it. Airbag replacement is a major expense that contributes to the repair cost, but it’s just one piece of a much larger puzzle.

The real decision comes down to a simple question: Will it cost more to fix the car than what the car was worth right before the crash? If the answer is yes, according to the insurer’s specific formula, then the car is declared a total loss.

So if deployed airbags don’t automatically total your car, what actually does?

Understanding “Totaled”: How Insurance Companies Really Decide

A car is totaled when the cost to repair it exceeds a certain percentage (typically 70-80%) of its pre-accident Actual Cash Value (ACV), a threshold that varies by state and insurer. An insurance adjuster’s job is to calculate these two key figures—the total repair estimate and the vehicle’s ACV—and see if the damage crosses their specific financial threshold.

Insurance companies primarily use one of two methods, which are often dictated by state regulations. Understanding which method your state or insurer uses is key to anticipating the outcome of your claim.

| Calculation Method | Formula / Rule | Typical Threshold (Varies by State) |

|---|---|---|

| Total Loss Threshold (TLT) | Repair Costs ≥ (ACV * Threshold %) | 70% to 80% |

| Total Loss Formula (TLF) | Repair Cost + Salvage Value ≥ ACV | Used by some states |

In the Total Loss Threshold (TLT) method, the insurer simply multiplies your car’s ACV by a percentage. If the repair estimate is higher than that number, it’s totaled. In the Total Loss Formula (TLF) method, they add the repair cost to the car’s potential value as scrap (salvage value). If that sum is more than the ACV, it’s totaled.

Pro Tip: Your car’s pre-accident Actual Cash Value (ACV) is the most critical number in this equation. It’s not what you paid; it’s what it was worth right before the crash.

What is Actual Cash Value (ACV)?

ACV is your car’s market value right before the accident, not what you paid for it. It is the amount of money it would have cost to buy your exact car—or a very similar one—from a dealer one minute before the collision occurred.

Insurance companies determine the ACV by looking at several key factors:

* Vehicle age

* Mileage

* Overall pre-accident condition (including any prior damage, dings, or scratches)

* Trim level and optional features

* Recent sales data for comparable vehicles in your local market

Think of ACV as what a similar car would have sold for at a dealership one minute before your accident. This is why a brand-new car and a 10-year-old car can suffer the exact same damage, but the older car is far more likely to be totaled—its lower ACV is much easier for repair costs to exceed.

The High Cost of Airbags: Why Deployment Often Leads to a Total Loss

Replacing deployed airbags is a significant expense, with a single airbag often costing $1,000 to $1,500. This high cost is a primary reason airbag deployment frequently contributes to a total loss determination. It’s not the airbag itself that totals the car, but its hefty price tag can easily push the total repair bill over the crucial total loss threshold, especially on older, less valuable vehicles.

The cost isn’t just for the bag itself. A complete and safe repair involves replacing a whole system of components. An adjuster’s estimate will include:

- Single Airbag Module: Well-established data indicates this can run from

$1,000 - $1,500including both the part and the specialized labor. - Multiple Deployed Airbags: If the passenger, side-curtain, or seat airbags also deployed, these costs multiply quickly, potentially reaching thousands of dollars.

- Associated Components: It’s rarely just the airbag. The system relies on impact sensors, a control module, and wiring, all of which often require replacement to ensure the system will function correctly in the future. In many cases, the deployment also damages the dashboard, steering wheel assembly, or seat upholstery, adding to the bill.

- Labor Costs: This is not a simple DIY job. Replacing airbag systems requires certified technicians to handle explosive components and recalibrate the system, making labor a significant portion of the cost.

Quick Fact: For an older car valued at $5,000, a $3,000 airbag repair bill could easily push it past the 50-75% total loss threshold. This same repair on a $40,000 vehicle would be a much smaller percentage of its value, making a total loss declaration less likely from the airbags alone.

Beyond Airbags: Other Factors That Can Total Your Car

Significant structural or frame damage, the car’s age and pre-accident value, and the extent of other mechanical repairs are often more critical than the airbags alone in determining a total loss. Airbag deployment is a symptom of a severe impact; the underlying damage caused by that impact is what an insurance adjuster is truly assessing.

Here is what an adjuster looks for, often in this order of importance:

- Frame or Unibody Damage: This is the skeleton of your vehicle. If the frame is bent, twisted, or cracked, it is extremely expensive and difficult to repair safely. A vehicle with significant frame damage is almost always a total loss because its structural integrity is compromised.

- Vehicle Age and Value: As discussed with ACV, an older, high-mileage car has a much lower value. Even moderate damage that would be easily repaired on a new car can exceed the total loss threshold on an older one.

- Widespread Mechanical Damage: Did the impact damage the engine, transmission, suspension, or steering components? These are all high-cost repair areas that can quickly add up, pushing the estimate higher.

- Flood or Fire Damage: Extensive damage from water or fire often results in a total loss, as it can compromise nearly every system in the vehicle, from the electronics to the interior.

- The “Nickel and Dime” Effect: Sometimes, it’s not one single big-ticket item but a long list of smaller repairs that seal the deal. A damaged bumper, fender, hood, headlight, radiator, and two deployed airbags can collectively create a repair bill that totals the car.

Rhetorical Question: Is hidden frame damage more costly than replacing two airbags? Often, the answer is yes. That’s why the adjuster’s full inspection is so crucial.

Your Immediate Checklist: What to Do After Airbag Deployment

After an accident with airbag deployment: 1. Ensure everyone is safe. 2. Contact your insurance company immediately. 3. Document everything with photos and a police report. 4. Get a professional repair estimate. In the chaotic moments after a crash, having a clear plan can protect your safety and your financial interests.

Important: Do not attempt to drive your vehicle. Deployed airbags indicate a severe impact, and driving it could be unsafe and illegal. There may be hidden damage that makes the car unpredictable, and the safety systems are no longer functional.

Follow these steps:

- Prioritize Safety: First and foremost, check on yourself and your passengers. If anyone is injured, call 911 immediately. If it’s safe to do so, move your vehicle out of the flow of traffic.

- Contact Authorities and Your Insurer: Call the police to file an official report. This document is critical for your insurance claim. Then, call the claims number for your insurance provider as soon as possible to get the process started.

- Document Everything: Use your phone to take extensive photos and videos of the accident scene from every angle. Capture the damage to all vehicles involved, the deployed airbags inside your car, skid marks, road conditions, and any relevant street signs.

- Exchange Information: Get the name, address, phone number, and insurance information from all other drivers involved.

- Get a Professional Estimate: Your insurance company will send an adjuster to inspect the vehicle and write an initial estimate. You also have the right to get an independent estimate from a trusted body shop.

Understanding Your Rights: Legal and Resale Value Considerations

Airbag deployment can significantly lower your car’s resale value, and you have legal rights to challenge an unfair insurance settlement or pursue a claim if airbag defects are suspected. The consequences of a major accident extend beyond the immediate repairs and can have long-term financial and legal implications.

Know your rights: If an insurance offer seems too low, you have the right to challenge it.

Unfair Settlement Offers

If you believe the insurance company’s ACV for your vehicle is unfairly low, you don’t have to accept it. You can present your own evidence, such as ads for comparable vehicles for sale in your area or a third-party appraisal, to negotiate a higher value. If negotiations fail, pursuing legal action may be an option to secure a fair settlement.

Product Liability and Airbag Defects

In some cases, airbags may be the cause of injury, not just a result of the accident. You may have a product liability claim if:

* Airbags failed to deploy in a crash where they should have.

* Airbags deployed improperly or with excessive force, causing severe injury.

* Airbags deployed without a significant impact, such as from hitting a pothole.

Diminished Value and Resale

Even if your car is not totaled and is repaired perfectly, its history of significant damage and airbag deployment will be noted on its vehicle history report. This will reduce its resale value, a concept known as “diminished value.” In some states, you can file a diminished value claim against the at-fault driver’s insurance to be compensated for this loss.

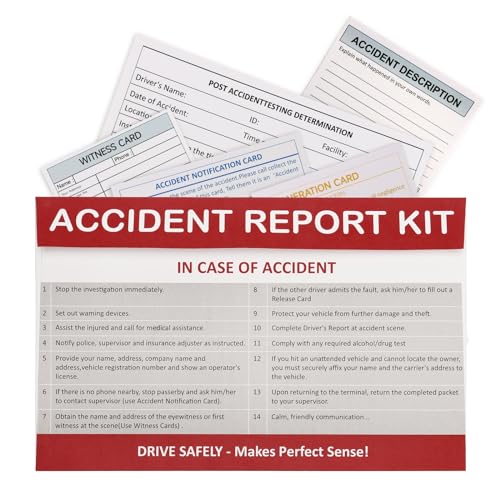

Having the right tools can make documenting your accident scene easier and more thorough, which is vital for your insurance claim. A dedicated car accident documentation kit can help ensure you don’t miss any critical details.

FAQs About Cars, Airbags, and Total Loss

Is a car automatically totaled if the airbags deploy in California or Florida?

No, no state, including California or Florida, automatically totals a car if airbags deploy. The decision is always based on the state’s specific total loss threshold or formula, comparing repair costs to the car’s value. California, for instance, generally uses the Total Loss Formula (TLF), where if the cost of repairs plus the salvage value meets or exceeds the car’s ACV, it’s declared a total loss. The principle remains financial, not mechanical.

Is it worth fixing a car with airbags deployed?

It is only worth fixing if the total repair cost (including airbags and all other damage) is significantly less than the car’s Actual Cash Value and less than the insurance company’s settlement offer. If the insurance company declares it a total loss, they will pay you the ACV (minus your deductible), and you can then buy a new vehicle. Attempting to repair a totaled car yourself is often a financial mistake, as hidden issues can arise and the car will have a salvage title, making it difficult to insure or resell.

Can you drive a car once the airbags have deployed?

No, you should not drive a car after the airbags have deployed. The vehicle’s safety systems are compromised, and there could be hidden structural damage making it unsafe. Driving it is not only dangerous but may also be illegal in your state. The deployment itself means the car sustained a heavy impact, and secondary issues with steering, suspension, or the frame could lead to another accident. Always have the vehicle towed.

Why does the insurance company ask if airbags deployed?

Insurance companies ask if airbags deployed because it indicates a significant impact, suggesting there is a higher likelihood of costly structural damage and making the high cost of airbag replacement a guaranteed factor in the repair estimate. It’s a key data point for them. Answering “yes” immediately tells the adjuster that the repair bill will start with a multi-thousand-dollar line item and that they need to perform an especially thorough inspection for hard-to-see frame and mechanical damage.

Final Summary: It’s About Cost vs. Value, Not Just Airbags

The definitive answer to whether your car is totaled if the airbags deploy is a clear and simple “no.” This common misconception creates unnecessary anxiety in an already stressful situation. The reality is a straightforward financial equation: a car is totaled only when the cost to fix it approaches or exceeds its value. Airbag deployment is a major red flag and a significant expense, but it is ultimately just one variable in that calculation.

The most critical factors are the vehicle’s Actual Cash Value (ACV), the state-mandated total loss threshold, and the full extent of the damage, especially to the vehicle’s frame.

- It’s a Myth: Airbag deployment is not an automatic death sentence for your vehicle.

- Follow the Money: The decision is always based on the repair estimate versus the car’s pre-accident value (ACV).

- ACV is King: The most important number in the entire process is your car’s Actual Cash Value.

- Look Beyond the Airbag: The cost of airbag replacement is high, but hidden structural damage is often the real reason a car is totaled.

Armed with this knowledge, you can navigate your insurance claim with more confidence. Focus on the numbers—the repair estimate and your car’s ACV—to understand the likely outcome. By understanding the process, you can ensure you are treated fairly and receive the settlement you deserve.

Last update on 2025-10-20 / Affiliate links / Images from Amazon Product Advertising API