Geico often offers the cheapest car insurance rates. State Farm and USAA are also known for low-cost options.

Finding affordable car insurance can be a challenge. Geico, State Farm, and USAA frequently top the list for budget-friendly coverage. Geico is renowned for its competitive rates and various discounts. State Farm provides affordable premiums, especially for good drivers. USAA offers excellent rates but is limited to military members and their families.

Comparing quotes from these insurers can help you find the best deal. Consider factors like coverage options, customer service, and discounts. By doing thorough research and comparing, you can secure the cheapest car insurance that meets your needs.

Credit: www.insure.com

Introduction To Affordable Car Insurance

Finding the right car insurance can be challenging. Everyone wants the best deal. Affordable car insurance doesn’t mean sacrificing quality. You can find low-cost coverage that still offers great protection.

The Quest For Low-cost Coverage

Many drivers search for the cheapest car insurance. The goal is to save money. There are ways to find low-cost options. Here are some tips:

- Compare quotes from different insurers.

- Look for discounts and special offers.

- Consider higher deductibles for lower premiums.

- Maintain a clean driving record.

These strategies can help you find budget-friendly insurance.

The Importance Of Value

Value is more important than just price. Affordable car insurance should still offer essential coverage. Look for policies that provide:

- Liability coverage to protect against third-party claims.

- Collision coverage for vehicle repairs.

- Comprehensive coverage for non-collision incidents.

- Personal injury protection for medical expenses.

Choosing the right policy ensures you get good value for your money.

| Insurance Type | Coverage Benefits |

|---|---|

| Liability | Protects against third-party claims |

| Collision | Covers vehicle repairs after an accident |

| Comprehensive | Covers non-collision incidents like theft |

| Personal Injury Protection | Covers medical expenses |

Factors Affecting Insurance Premiums

Understanding the factors that affect your car insurance premiums is crucial. These factors determine how much you pay for your coverage. Knowing them can help you find the cheapest car insurance. Below are some key factors that influence car insurance premiums.

Age And Driving Experience

Age plays a significant role in your insurance rates. Younger drivers typically pay more. Driving experience also affects your premiums. New drivers usually have higher rates. Insurance companies see them as high-risk.

Here’s how age and experience impact premiums:

| Driver’s Age | Average Premium |

|---|---|

| Under 25 | $2,400 |

| 25-34 | $1,800 |

| 35-50 | $1,500 |

| Over 50 | $1,200 |

Vehicle Make And Model

The make and model of your car can affect your premiums. Luxury cars cost more to insure. They are expensive to repair or replace. Sports cars also have high premiums. They are often driven faster, increasing accident risks.

Insurance companies consider these factors:

- Cost of repairs

- Safety features

- Theft rates

Location And Crime Rates

Where you live influences your insurance costs. Location impacts risk levels for insurers. Urban areas usually have higher premiums. This is due to higher traffic and accident rates.

Crime rates in your area also matter. Areas with high theft or vandalism rates have higher premiums. Insurers charge more to cover these risks.

Here is a simple breakdown:

- Urban areas: Higher premiums

- Suburban areas: Moderate premiums

- Rural areas: Lower premiums

Types Of Coverage

Choosing the right car insurance means understanding the different types of coverage. Each type offers unique benefits and costs. Knowing these can help you find the cheapest option that still meets your needs.

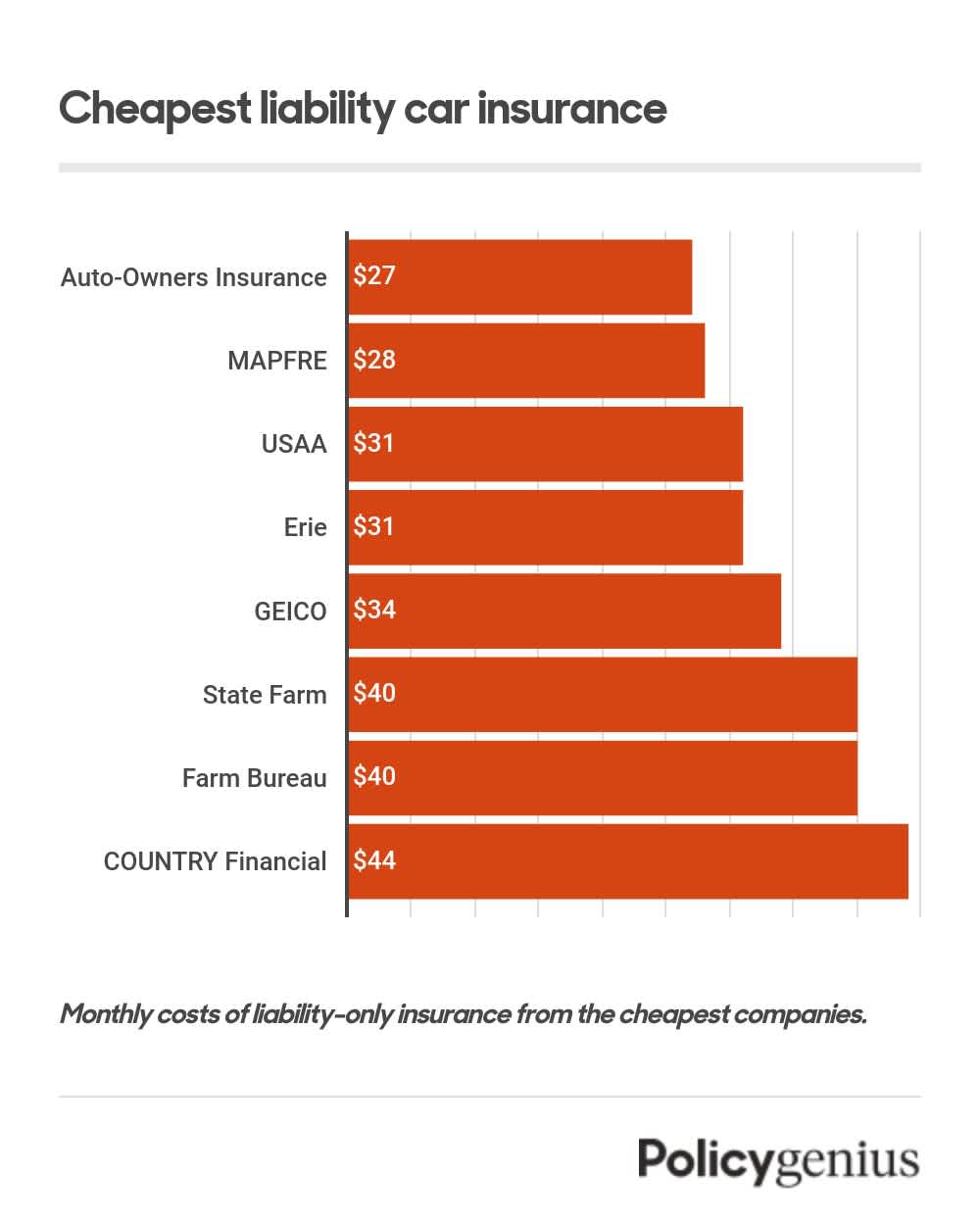

Liability Vs Full Coverage

Liability insurance covers damage you cause to other people or property. It does not cover your own car or injuries. Full coverage includes liability, collision, and comprehensive insurance. This means it covers damage to your car too, even if you are at fault.

Liability insurance is usually cheaper than full coverage. This is because it covers less. Full coverage costs more because it offers more protection. Choosing between liability and full coverage depends on your car’s value and your budget.

- Liability Insurance: Covers others’ property and injuries.

- Full Coverage: Covers your car, others’ property, and injuries.

Understanding Deductibles

A deductible is the amount you pay out of pocket before insurance pays. Higher deductibles mean lower monthly premiums. Lower deductibles mean higher monthly premiums. Choosing the right deductible affects your insurance cost.

Consider how much you can afford to pay upfront in case of an accident. A higher deductible can save you money on premiums. But you need to be ready to pay more out of pocket if something happens.

| Deductible Amount | Monthly Premium |

|---|---|

| $500 | $150 |

| $1,000 | $100 |

Choosing the right coverage and deductible can help you find the cheapest car insurance. Assess your needs and financial situation to make the best choice.

Shopping For Insurance

Finding the cheapest car insurance requires some effort. You need to compare various options. Shopping for insurance can save you money.

Comparing Quotes Online

Comparing quotes online is the easiest way. Many websites let you enter your details. They will show you quotes from different insurers.

You can use comparison websites like:

- Geico

- Progressive

- State Farm

Use these sites to compare prices. Look for the best deals.

The Role Of Insurance Agents

Insurance agents can help you find good deals. They know the market well. Agents can provide personalized advice.

Agents can explain policy details. They can help you understand what you are buying. They can also find discounts you might miss online.

Consider these points to get the cheapest car insurance:

| Method | Pros | Cons |

|---|---|---|

| Comparing Quotes Online | Quick and easy | May miss personalized discounts |

| Using Insurance Agents | Personalized advice | May take longer |

Discounts And How To Qualify

Finding the cheapest car insurance often means exploring various discounts. Many insurance companies offer discounts. These discounts help reduce your premium. Understanding these discounts is crucial. Let’s dive into some common discounts and how you can qualify for them.

Safe Driver Discounts

Insurance companies reward safe drivers. They offer discounts to those with clean driving records. Here are the main qualifications:

- No accidents in the last three years

- No traffic violations in the last three years

- Completion of a defensive driving course

Avoiding accidents and traffic tickets is key. Defensive driving courses can also help you qualify.

Bundling Policies

Bundling your policies can save you money. This means getting multiple policies from the same insurer. For example:

| Policy Type | Discount |

|---|---|

| Car + Home Insurance | Up to 25% |

| Car + Renters Insurance | Up to 15% |

| Car + Life Insurance | Up to 10% |

Bundling policies simplifies your payments. It also provides significant discounts.

Student And Military Discounts

Students and military members often get special discounts. Here’s how they qualify:

- Students: Maintain a GPA of 3.0 or higher

- Military: Active duty, reserves, or veterans

Insurance companies value responsible students and military members. Proof of eligibility might be required.

The Impact Of Credit Score On Premiums

Your credit score can greatly affect your car insurance premiums. Insurers use credit scores to predict risk. A higher score often means lower premiums. A lower score can result in higher costs. Understanding this can help you save money on car insurance.

Improving Your Credit

Improving your credit score can reduce your insurance premiums. Here are some tips:

- Pay your bills on time.

- Reduce your debt.

- Check your credit report for errors.

- Keep old accounts open.

- Limit new credit applications.

These actions can help improve your credit score over time.

Insurance Scoring Explained

Insurance scoring is different from credit scoring. Insurers create a score based on your credit report. This score helps them predict your insurance risk. Here are some factors they consider:

| Factor | Impact |

|---|---|

| Payment history | High impact |

| Debt levels | High impact |

| Credit age | Moderate impact |

| Credit mix | Low impact |

| New credit | Low impact |

Understanding these factors can help you improve your insurance score. This can lead to lower car insurance premiums.

Usage-based Insurance Savings

Usage-based insurance (UBI) offers savings for careful drivers. It uses technology to track your driving habits. Insurers reward safe driving with lower premiums. Let’s explore two popular UBI options: telematics devices and pay-as-you-drive plans.

Telematics Devices

Telematics devices monitor your driving behavior. They record data like speed, braking, and mileage. This data helps insurers offer personalized rates. Safe drivers can save a lot on their premiums.

Telematics devices are easy to install. Most plug into your car’s OBD-II port. Some insurers offer smartphone apps instead. These apps use your phone’s GPS to track driving.

Key Benefits:

- Potential for significant savings

- Improved driving habits

- Immediate feedback on driving behavior

Many insurers offer discounts for using telematics devices. Always check with your provider for specific details.

Pay-as-you-drive Options

Pay-as-you-drive (PAYD) insurance bases premiums on mileage. You pay for the distance you drive. This option is great for low-mileage drivers.

Insurers use different methods to track mileage. Some require odometer readings. Others use telematics devices or smartphone apps.

Advantages of PAYD:

- Cost-effective for infrequent drivers

- Encourages reduced driving

- Simple and transparent billing

PAYD can be a budget-friendly choice. It offers more control over your insurance costs.

| Usage-Based Insurance Type | Key Feature | Ideal For |

|---|---|---|

| Telematics Devices | Monitors driving behavior | Safe drivers |

| Pay-As-You-Drive | Bases premiums on mileage | Low-mileage drivers |

Maintaining Low Premiums Over Time

Maintaining low car insurance premiums over time is a goal for many. It requires consistent effort and smart practices. Regular policy reviews and safe driving habits play a key role in this. By focusing on these aspects, you can keep your insurance costs low.

Regular Policy Reviews

Review your car insurance policy every six months. This helps you find better rates and discounts. Compare your current policy with other providers. Look for new offers and ask your insurer for any available discounts.

Use an online insurance comparison tool for quick results. Ensure you update your information regularly. Changes in your driving habits or vehicle usage can impact your premium. Keeping your policy up-to-date ensures you get the best rates.

Safe Driving Habits

Adopt safe driving habits to reduce your insurance premium. Avoid speeding and always obey traffic rules. Insurance companies reward safe drivers with lower premiums.

Install a telematics device in your car. This device monitors your driving behavior. Insurers use this data to offer discounts for safe driving. Additionally, avoid accidents and traffic violations. A clean driving record is crucial for maintaining low premiums.

Here are some tips for safe driving:

- Follow speed limits

- Use seat belts

- Avoid distractions while driving

- Maintain a safe distance from other vehicles

Remember, safe driving and regular policy reviews are key to low car insurance premiums.

Additional Tips For Cost Savings

Finding the cheapest car insurance requires some strategic decisions. Below are helpful tips to save money on car insurance. Each strategy is simple and effective.

Higher Deductibles For Lower Premiums

Raising your deductible can significantly reduce your monthly premiums. A deductible is the amount you pay out-of-pocket before your insurance covers the rest. For example, choosing a $1,000 deductible instead of $500 can lower your premiums by up to 25%. Consider this option if you have a good driving record and can afford higher upfront costs in case of an accident.

Reducing Coverage On Older Cars

Older cars often do not need comprehensive and collision coverage. These types of insurance are usually more expensive than the car’s value. For cars older than 10 years, consider dropping these coverages. This can save you hundreds of dollars each year. Instead, focus on maintaining liability coverage, which is often required by law.

Here’s a quick comparison:

| Car Age | Recommended Coverage | Potential Savings |

|---|---|---|

| 0-5 years | Full Coverage | Minimal |

| 6-10 years | Partial Coverage | Moderate |

| 10+ years | Liability Only | High |

Use these tips to identify where you can save money on your car insurance.

Credit: www.valuepenguin.com

Credit: www.policygenius.com

Frequently Asked Questions

Who Typically Has The Cheapest Car Insurance?

Young drivers and those with clean driving records typically get the cheapest car insurance. Shop around for quotes. Discounts from bundling policies or maintaining good credit can also lower rates.

Who Is The Cheapest Car Insurance Company?

Geico often offers the cheapest car insurance rates. Shop around to compare quotes from multiple providers.

What Is The Lowest Form Of Car Insurance?

The lowest form of car insurance is liability insurance. It covers damages to others if you’re at fault.

Who Is Cheaper, Geico Or Progressive?

Geico is often cheaper for many drivers, but it depends on individual circumstances. Compare quotes from both to find out.

Conclusion

Finding the cheapest car insurance requires research and comparison. Always evaluate coverage options and discounts. Use online tools to compare rates. Speak with insurance agents for personalized quotes. Prioritize value and customer service over just price. A well-informed choice ensures both savings and peace of mind.

![What Car Is Chevy Bringing Back in [year]? New Lineup Revealed 14 What Car Is Chevy Bringing Back in [year]? New Lineup Revealed](https://carxplorer.com/wp-content/uploads/2026/01/What-Car-Is-Chevy-Bringing-Back-in-year-New-Lineup-Revealed-1-1-60x60.jpg)